Highlights

- Climate policy is set to take a major U-turn under Donald Trump’s second term. The president-elect will likely prioritize rolling back regulatory powers and direct spending that expanded significantly under President Biden.

- The Inflation Reduction Act’s marquee tax credits are also on the chopping block. There are several executive and procedural tools available to the incoming administration to roll these back as well, including rewriting tax guidance, leveraging the Congressional Review Act and existing legal challenges to agency rulemaking.

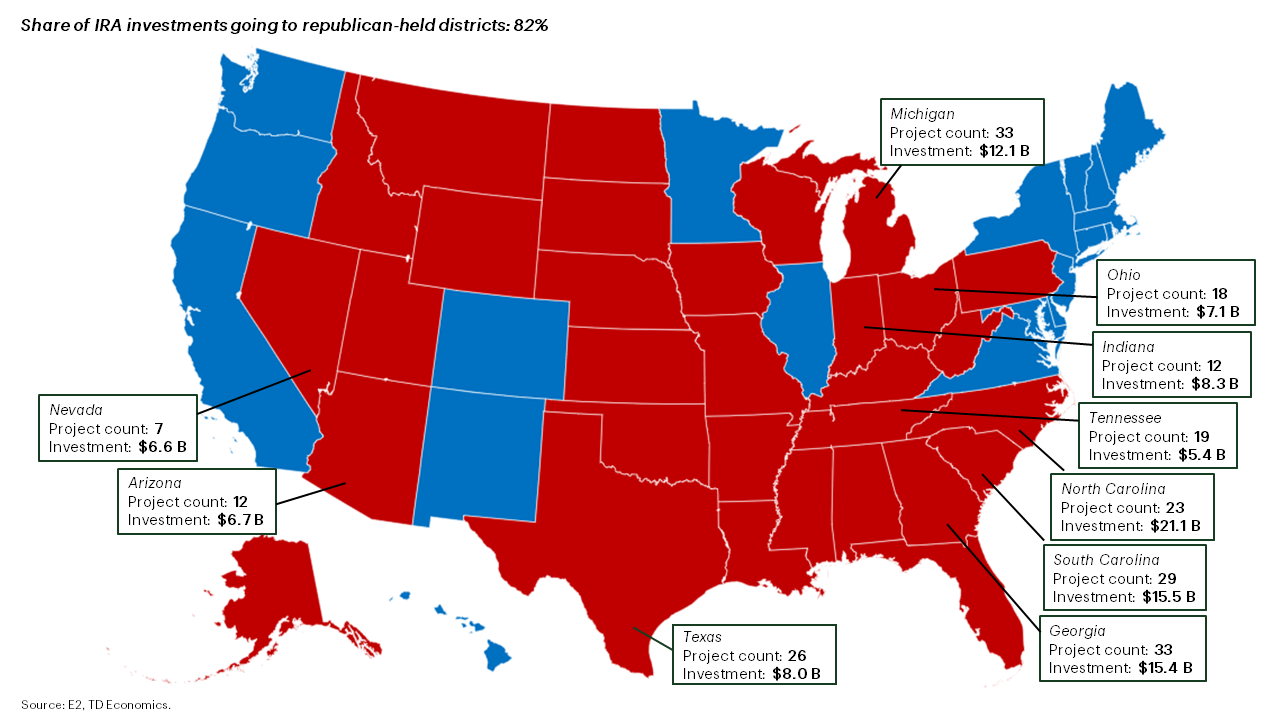

- There will be, however, legislative challenges to cutting tax credits in that 82% of estimated investments related to the Inflation Reduction Act have gone to districts held by Republicans.

- The potential for the Trump administration to open fiscal room by cutting the IRA could be significant, however. Updated estimates of total climate spending under Biden now top $1 trillion over the next decade – funds that could be re-prioritized to tax cuts and other preferred policy measures.

In the lead-up to President-elect Trump’s inauguration next year, discussion is already occurring around where climate policies and spending will be cut. Republicans have pushed against climate spending repeatedly since the passing of President Biden’s marquee Inflation Reduction Act (IRA), with multiple attempts by the house and senate to block or repeal certain aspects of the legislation. For his part, Trump has consistently promised to divert funding to other priority areas and undo as much of the legislation as possible.

Even during Biden’s term, there were already 30 individual attempts1 at repealing parts of the IRA by republican members of congress using a variety of procedural tools – leveraging control of house committees to introduce bills at either the house or senate, Congressional Review Act resolutions, and amendments to appropriations bills. While these efforts ultimately failed, it does show a relatively unified front in undoing key parts of the IRA since some of the bills did at least pass the house.

So what do we think is going to be on the chopping block in the coming months?

Exhibit 1: IRA Regulations & Key Spending

| Key examples | Original scoring (CBO estimate), $ Billions | Updated scoring (Goldman Sachs estimate), $ Billions | |

| Regulations | EPA methane emission reduction program | -- | -- |

| EPA source performance standards for fossil fuel power plants | -- | -- | |

| EPA multi-pollutant emissions standards for light- and medium-duty vehicles | -- | -- | |

| SEC climate disclosure requirements | -- | -- | |

| Clean vehicle & energy tax provisions | Clean electricity | 161 | 274 |

| Energy efficiency | 37 | 44 | |

| Manufacturing | 37 | 193 | |

| Electric vehicles | 14 | 393 | |

| Clean hydrogen | 13 | 49 | |

| Biofuels | 6 | 43 | |

| Carbon capture and sequestration | 3 | 34 | |

| Total tax credit spending | 272 | 1030 | |

| Direct spending (loan programs & financing initiatives) | Agriculture and forestry | 21 | -- |

| Energy grants and loans | 28 | -- | |

| DOE Loan and Grant Programs | 10 | -- | |

| Air pollution | 30 | -- | |

| Other grants and loans | 41 | -- | |

| Total grants and loans | 121 | 120 | |

| Total IRA spending | 393 | 1150 |

Breaking down climate spending and regulation during Biden’s term

The centrepiece of Biden’s climate policies was obviously the IRA, a mammoth piece of legislation that allocated hundreds of billions into production and investment tax credits for greening the electricity grid, carbon capture, clean technology manufacturing, and rebates for electric vehicles and green home retrofits. However, while those big-ticket items made most headlines, much less discussed were direct spending initiatives, loan & financing programs, and most notably, a significant expansion of regulatory powers for government departments and agencies. The IRA was also accompanied by the Bipartisan Infrastructure Law – a key piece of legislation that had some elements of the energy transition baked in, including the National Electric Vehicle Infrastructure program.

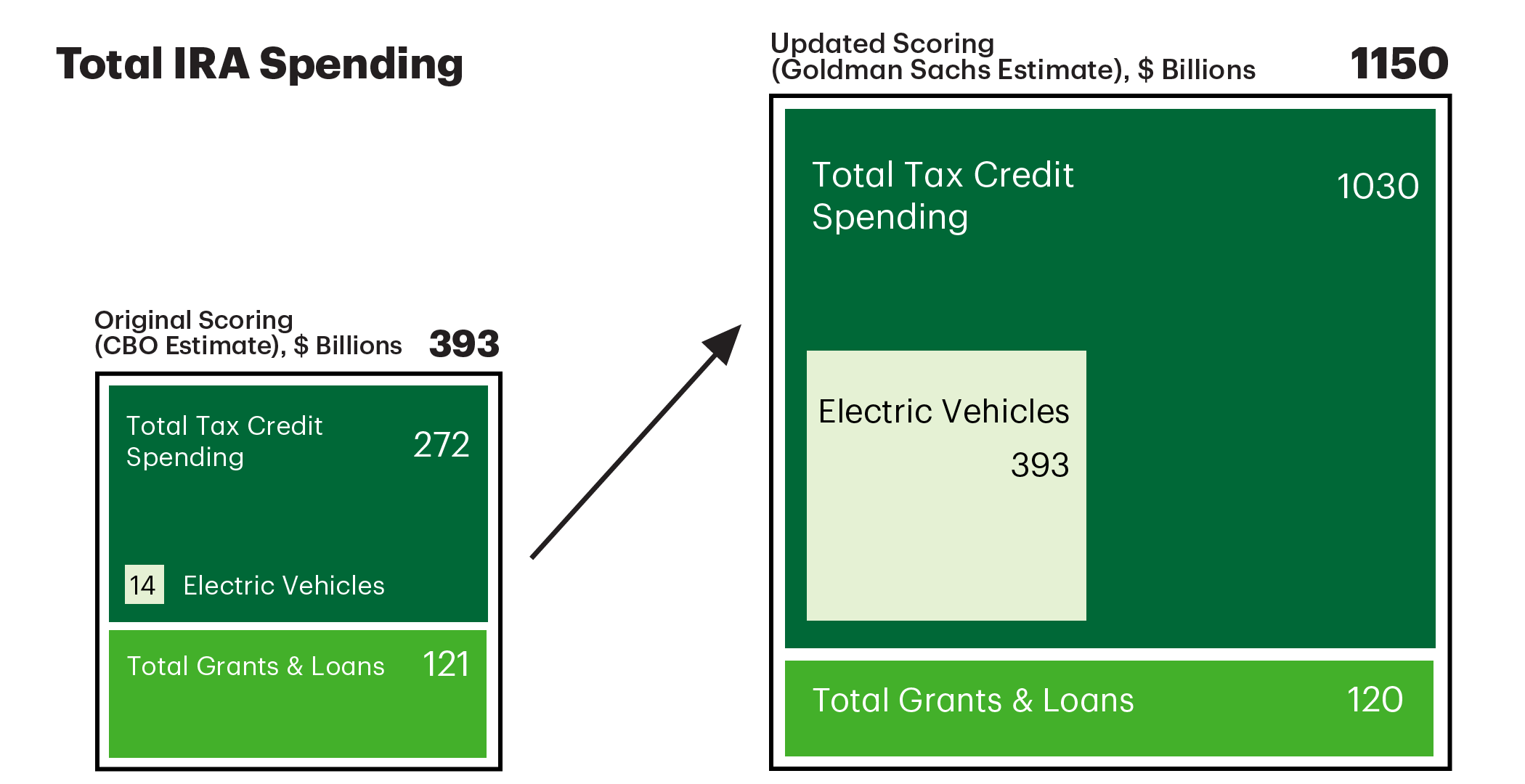

The Joint Committee on Taxation (JCT) originally scored the IRA at approximately $370 billion in total spending over a 10-year timeframe (later updated by the CBO to $393 billion). More than two years have since passed and it is clear that their original scoring was woefully insufficient. There are two reasons for this. First, the investment and production tax credits were uncapped, and the original scoring underpredicted demand. A total of 354 clean energy and manufacturing projects alone have been announced since passage of the IRA, with investment dollars alone totaling $130 billion2. Given a preference for production tax credits with payout over the life of a given facility, the financial liability for the government has increased significantly.

Moreover, the interaction between regulation and tax credits has also become clearer. A key example of this is the Environmental Protection Agency’s (EPA) recent multi-pollutant emissions standards for light- and medium-duty vehicles, which strictly limits tailpipe emissions through 2032. The EPA estimated that automakers would require approximately 72% of sales to be BEVs and hybrids to reach that target3. This resulted in a significant increase in the estimated federal liability for EV rebates.

In thinking about what Trump then might reverse and its broader fiscal impact, we can broadly break down climate policy under the Biden Administration into three buckets: Regulation, clean vehicle & energy provisions (tax credits), and direct spending, including loan & financing programs.

Exhibit 2: Major Clean Energy Projects since Passage of the IRA

What is and isn’t on the chopping block?

Regulations

The regulatory environment is one that will almost definitely change under Trump. The Environmental Protection Agency, for example, has experienced a roller coaster between Trump and Biden. As already discussed, Biden significantly expanded the EPAs powers, allowing them to establish a suite of key regulations covering the power sector, methane emissions, and tailpipe emissions. But prior to that, Trump’s first term saw their regulatory authority carved out. By the end of his term, he had rolled back over 100 regulations related to air pollution, oil & gas exploration, and other environmental protections4.

Trump has already made it clear that he intends on reversing big ticket regulations such as the EPAs multi-pollutant emissions standard for vehicles, methane regulations that would have mandated an 80% reduction in projected emissions in the oil & gas sector5, and fossil fuel power plant rules that would have required carbon capture systems. The Department of Transportation corporate average fuel economy standards are also likely to shift under a new cabinet head.

What is less clear is what will happen to the kind of regulatory reform under Biden where the Trump administration has less ideological opposition. These include accelerating permitting and environmental assessments for clean energy and manufacturing projects, lowering fees for renewable energy development on federal lands, hard-capping federal review processes for electricity transmission project assessments, critical mineral permitting, among a slew of others aimed at more efficient government processes. President Trump can and likely will still reverse course on some of these regulations and can issue executive orders either stopping any rulemaking that has not yet been finalized or, for any regulation that is currently being litigated, prevent further defense in court and remand the regulation back to the agency where it could die on the vine.

Direct spending

These programs are also likely to be chopped in the early stages of Trump’s term. Direct rebates, such as the $7,500 direct rebate for electric vehicle purchases and those to homeowners for heat pump adoption or home efficiency measures, are obvious candidates.

Key spending in this category also included a significant boost to the Department of Energy Loan Program Office that originated low-cost loans or provided loan guarantees through a number of streams, including the Title 17 Clean Financing Program, the Title 17 Energy Infrastructure Reinvestment program and Advanced Technology Vehicles Manufacturing program. These programs were already in existence prior to the IRA and the Biden Administration expanded their loan authority, provided additional funding for guarantees or credit subsidies, and expanded project eligibility. Authorizations not yet used could be clawed back – the DoE reported6 remaining loan authority of close to $400 billion as of November. All of these are easy cuts given that they are not obligated and could have a massive fiscal impact, particularly given the size of expected spend on electric vehicle rebates.

The Greenhouse Gas Reduction Fund – Biden’s “Green Bank” initiative – is also likely to be in the crosshairs, but could be challenging to reverse. The fund was primarily used as a lending vehicle for low-income and disadvantaged communities that would otherwise face difficulty in accessing funding for adopting clean technologies. Managed by the EPA, the fund has already obligated all $27 billion of its original budget authority to grant recipients – primarily non-profits involved in local financing, affordable housing, residential decarbonization, and community reinvestment. If the Biden administration is able to dole out the funding in time (a key priority for the agency right now), then clawing funds back will be difficult.

Tax credits

The elephant in the room. The bulk of IRA money obligated is in the form of uncapped production and investment tax credits (PTC/ITC), most of which has yet to actually be spent. According to the CBO, most of the spending related to these credits (which skew towards PTCs) occurs beyond 2025 when the bulk of new facilities are projected to come online. Trump has stated he intends on rescinding any unspent funds and a raft of tools would allow his administration to reverse course.

A bit of procedural background: after a bill becomes law, federal agencies and departments are then tasked with issuing guidance on the law’s specific scope, eligibility, and implementation. Proposed guidance is issued, followed by public consultation, revisions, and final guidance. The Treasury department along with the IRS have reportedly issued 75 pieces of individual guidance as of October, with several more since then. Final guidance for the 45X advanced manufacturing production tax credit, for example, was issued on October 24th. Final guidance for direct pay rules for the clean energy tax credit, allowing state and local governments, non-profits, and other public entities that have no federal tax liability to still receive the credit, was only finalized on November 19th. There are also elements of the IRA that have yet to receive final guidance at all, including the 45V tax credit for clean hydrogen production.

The Trump administration can use several tools to unwind the IRA’s tax credits:

- As mentioned above, executive order that stops any further progress on rulemaking that is not yet finalized or preventing any agency from further defending rules currently in litigation and remanding the rule back to the agency. This would be followed by either rewriting guidance that heavily restricts eligibility or delaying new guidance outright.

- A notable development here is the Supreme Court overturning the Chevron Doctrine in July. This longstanding rule, also referred to as Chevron deference, applied in situations where statutes in law were vague – if a rule was ever litigated, courts would defer to the expertise of the agency or department. The doctrine’s overturning opens up the IRAs tax credits and regulations to litigation even after the rule has been finalized, which is why notionally any tax credit could be on the chopping block if the agency is sued over that particular rule.

- The Congressional Review Act (CRA) has a lookback mechanism that allows congress to review any agency rule issued within the previous 60 senate session days to be reviewed. The Congressional Research Service has highlighted August 1, 20247 as the cutoff date for the next congress to use the CRA. A simple majority disapproval vote by both houses on any rule that was not finalized by that date would vacate the rule and prevent further drawing from the tax credit.

- Through budget reconciliation, the Trump administration could add sunset clauses to tax credits and use appropriated budget for other fiscal priorities.

In short, there are tools that put essentially everything on the table. There is but one defense: that there simply is not sufficient support in Congress to eliminate everything given that most of the obligated tax credits and spending related to the IRA has gone to areas controlled by republicans.

Of the clean energy & technology projects announced since mid-20228, 82% of estimated investments have gone to districts held by republicans. By state, the top 10 receiving IRA dollars are all republican, including 4 that flipped to Trump in the election: North Carolina ($21.1 billion), South Carolina ($15.5 billion), Georgia ($15.4 billion), Michigan ($12.1 billion), Indiana ($8.3 billion), Texas ($8 billion), Ohio ($7 billion), Arizona ($6.7 billion), Nevada ($6.6 billion), and Tennessee ($5.4 billion). As such, even removing individual tax credits that would mothball those investments could be a challenge given slim margins in the house9.

Fiscal impact & what to watch

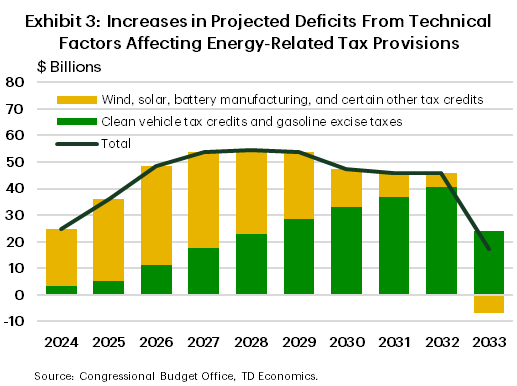

The potential fiscal impact of unwinding the IRA (or at least large portions of it) and its associated regulations are large. In their February budget and economic outlook, the CBO estimated that technical revisions to their understanding of the IRA led to an increase in the budget deficit by $428 billion through 2033, with more than half of the increase due to the EPAs multi-pollutant emissions standard (Exhibit 2). Of the $224 billion estimated impact, $151 billion is attributable to reductions in revenues due to lower excise taxes on gasoline sales.

In testimony to the Senate Committee on the Budget in August, the director of the CBO indicated that, in the 11-year period between 2024-2034, the IRA’s clean vehicle and energy provisions will add approximately $840 billion to the deficit. This is consistent with Goldman Sachs estimates for total IRA spending exceeding $1 trillion (Exhibit 1). President-elect Trump has made it clear that extending the TCJA tax cuts will be a top early priority for his administration – rescinding regulations by the EPA and others would open plenty of fiscal space for those other priorities.

All said, the battle for the IRA will be fought behind the scenes. Look to individual CRA motions, court cases, executive orders, and rewritten guidance that test the support for each individual tax credit and how many house representatives and senators step up to defend it along with estimates of the fiscal impact of new tax measures in order to assess where Trump will prioritize cutting in order to free up fiscal space.

End Notes

- https://climatepower.us/research-polling/inflation-reduction-act-repeal-votes-tracker/

- https://e2.org/announcements/

- https://www.nytimes.com/2024/11/21/climate/gm-ford-electric-vehicles-trump.html

- https://www.nytimes.com/interactive/2020/climate/trump-environment-rollbacks-list.html

- https://www.epa.gov/system/files/documents/2023-12/key-things-to-know-about-epas-final-rule-for-oil-and-natural-gas-operations.fact-sheet.pdf

- https://www.energy.gov/lpo/articles/updates-estimated-remaining-loan-authority-lpo-programs

- https://crsreports.congress.gov/product/pdf/IN/IN12408

- https://e2.org/announcements/

- https://www.eenews.net/articles/green-energy-credits-see-growing-republican-support/

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: