Highlights

- Canada and China recently entered a two-pronged strategic partnership. Tariff reductions will add an immediate layer of support to Canadian trade, while foreign investment benefits will unfold more slowly over time.

- The stock of Chinese direct investment in Canada could grow to around $90-100 billion over the next five years. This projection includes a cumulative $15 –25 billion of investment above a scenario in which no agreement was reached.

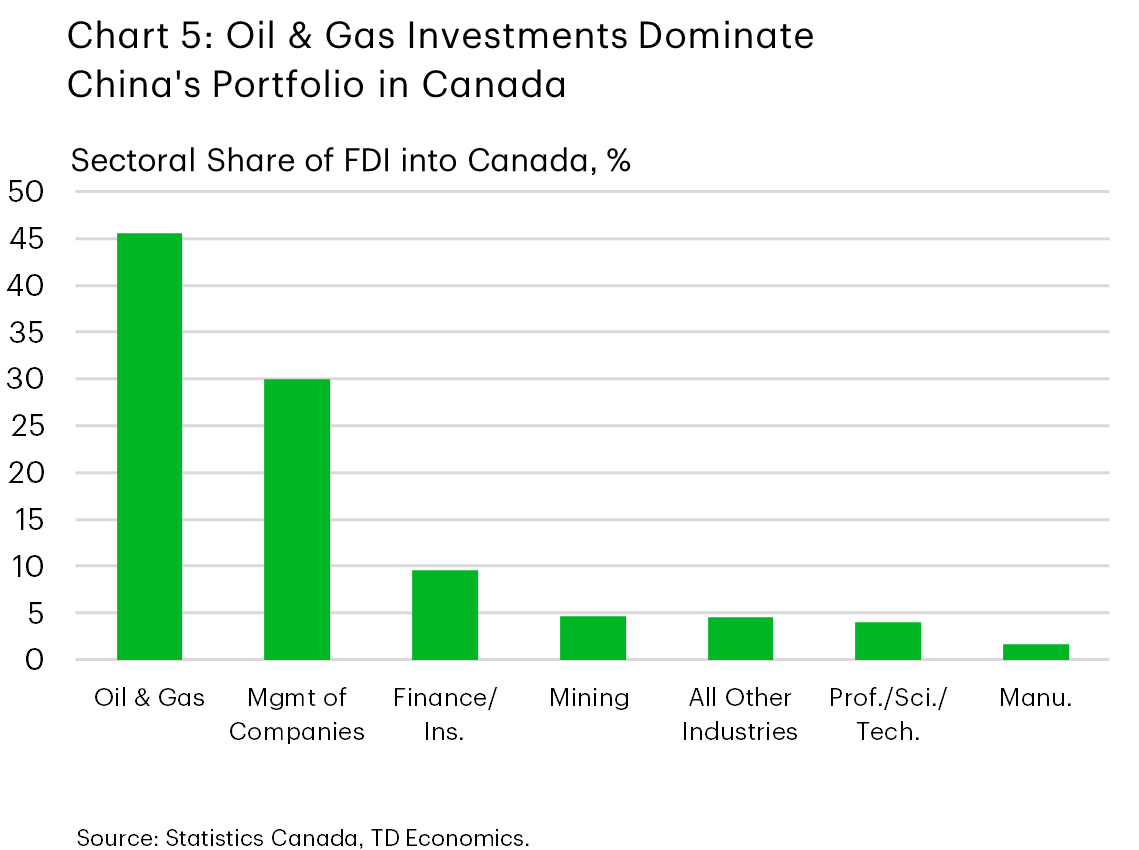

- Investment momentum is likely to remain strongest in Canada’s oil and gas sector, while EV, agri-food and technology investments will begin to gain traction. Investment in sensitive sectors like critical minerals, AI and telecommunication will remain tightly constrained by the Investment Canada Act.

- Deeper engagement with China has created some friction with the U.S. ahead of USMCA renegotiations, reinforcing limits on how far Canada can expand trade and investment ties.

Canada and China recently established an ‘Economic and Trade Cooperation Roadmap’, signaling a shift in economic strategy toward greater engagement with one another. The headline of the new deal was transparent and aimed at easing trade barriers between the two nations. By March 1st, Canada will reduce the 100% tariff rate on Chinese EVs to a Most-Favoured-Nation (MFN) rate of 6.1% while implementing an annual import quota of 49,000 vehicles (rising to 70k by 2030). In return, China will lower tariffs on Canadian agricultural exports, including canola seed – cut from around 84% to 15% – and will remove or reduce duties on products such as lobsters, peas, crabs, and canola meal.

In the near-term, this could alleviate some pressure on overall Canadian trade, while supporting the country’s efforts to expand its export rotation beyond North American borders. Indeed, Chinese tariffs have significantly impacted Canadian canola product exports – down by over 50% year-to-date (YTD) as of October 2025. Other tariffed products, like seafood, pork, and peas, have also seen YTD export declines ranging from 10% to 30%. The revised tariff structure offers relief for agricultural trade, and it is expected that Canada will recover part, though not all, of the lost exports in 2026. Regarding EVs, current import quotas mean EV imports will represent just 3% of total auto sales, with a slight increase as quota limits rise in coming years. While Teslas continue to dominate EV imports under the quota, several Chinese EV manufacturers are showing interest in entering the Canadian market.

The investment parameters of the new deal are where things become more opaque. The two nations jointly signed a Memorandum of Understanding (MoU) to stimulate bilateral investment, focused in areas including energy (both renewable and non-renewable), clean technology, agriculture and food, and consumer and technology sectors. This MoU does not constitute a binding investment treaty; it merely builds on existing pathways without outlining specific investment quotas or financing guarantees. And unlike the trade-specific components of this deal, the net investment impact could take several years to be fully realized. Should Canada and China be successful in recalibrating their economic interests, we see inbound Chinese capital as a growing piece of Canada’s broader plan to catalyze $500 billion in private investment over the next five years.

China-Canada Investment Landscape

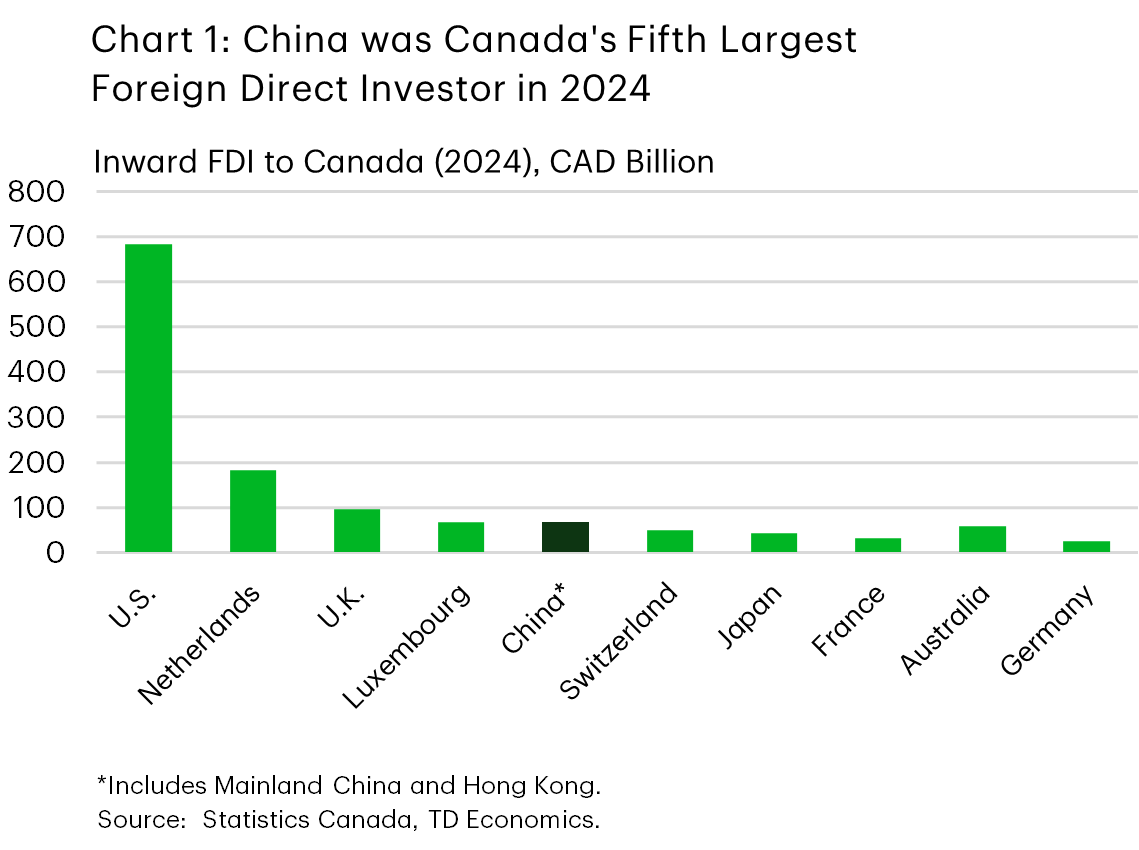

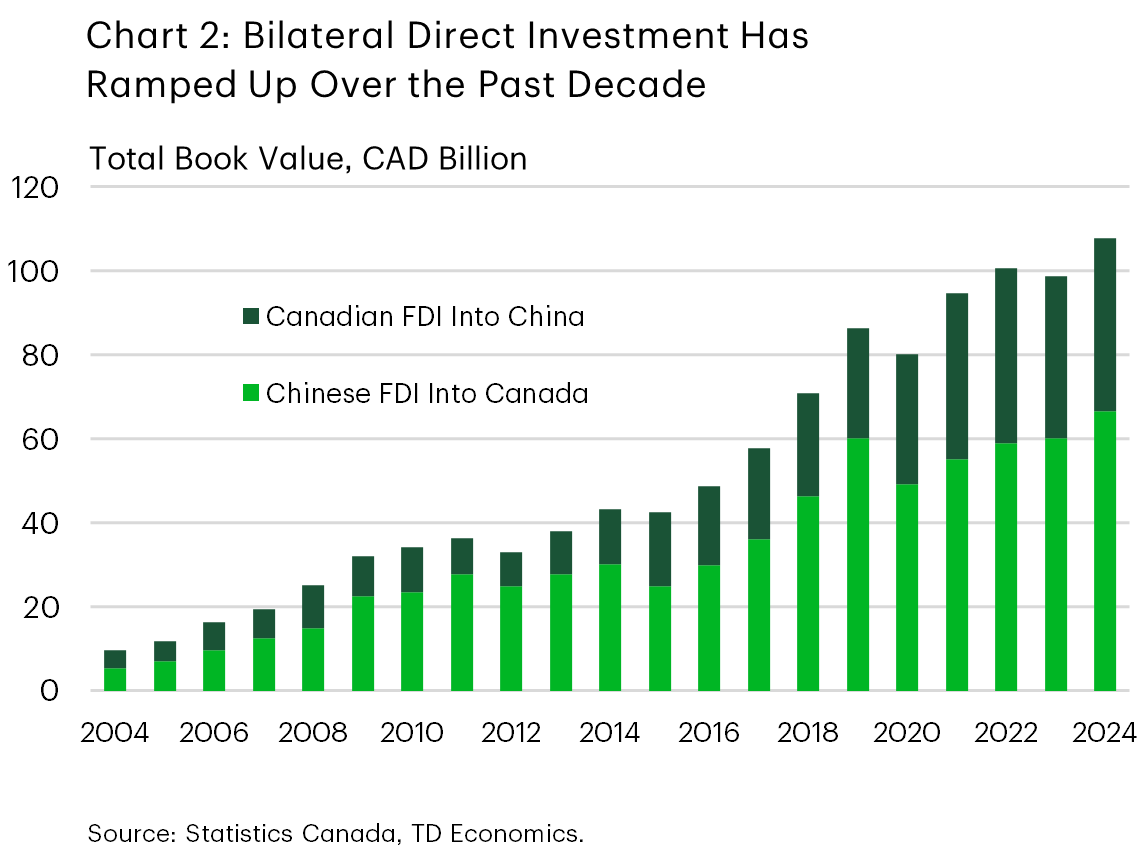

Historically, Canada and China have maintained a significant investment partnership. As of 2024, China (including Mainland China and Hong Kong) ranked as the fifth largest source of foreign direct investment (FDI) into Canada (Chart 1). What’s more, bilateral FDI stocks between Canada and China reached over 100 billion in 2024—the highest level on record and more than double the level recorded a decade ago (Chart 2). Compositionally, Canadian FDI into China accounts for around $40 billion of the cumulative bilateral stock, while Chinese FDI flows account for the remaining $65 billion.

Despite these all-time high investment levels, the pace of bilateral investment growth – particularly of Chinese FDI into Canada – has slowed since 2019. That slowdown reflects a mix of political tensions, increased regulatory scrutiny in Canada, Chinese capital controls and pandemic related disruptions. This partnership comes at an opportune time as it allows both nations to course-correct economic relations during a time where the push to diversify across global markets is intensifying.

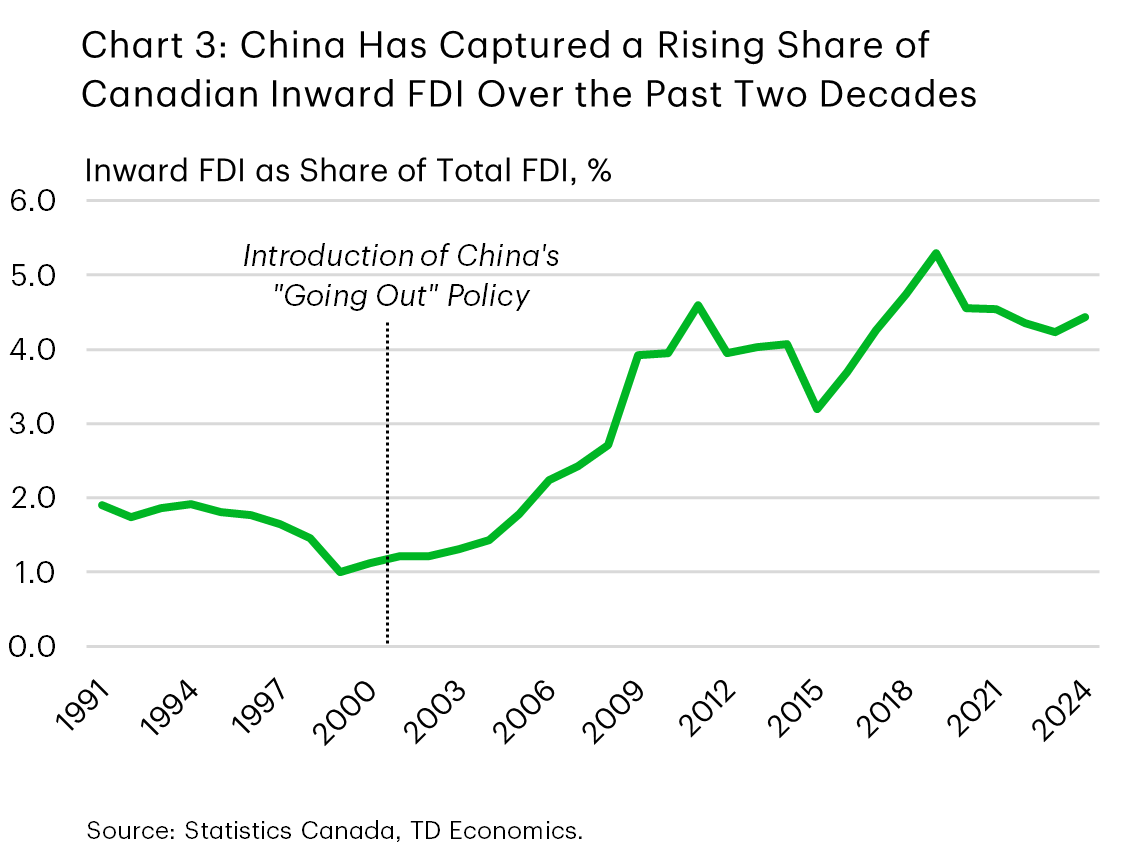

Identifying the upside to future investment potential is a key question. We can look to the early-2000s to get a sense for how investment flows react to certain structural, political and strategic shifts. China introduced a “Going Out” policy at the turn of the century, which actively encouraged Chinese firms to invest overseas. Canada was considered a suitable candidate for investment, as Chinese investors at that time primarily sought out countries abundant in natural resources. As a result, the share of inward FDI to Canada from China shot higher from 1.5% in 2004 to over 4% in the years following the policy’s introduction. That share would eventually reach over 5% by 2019 before ultimately finding a steady state of around 4.5% in recent years (Chart 3).

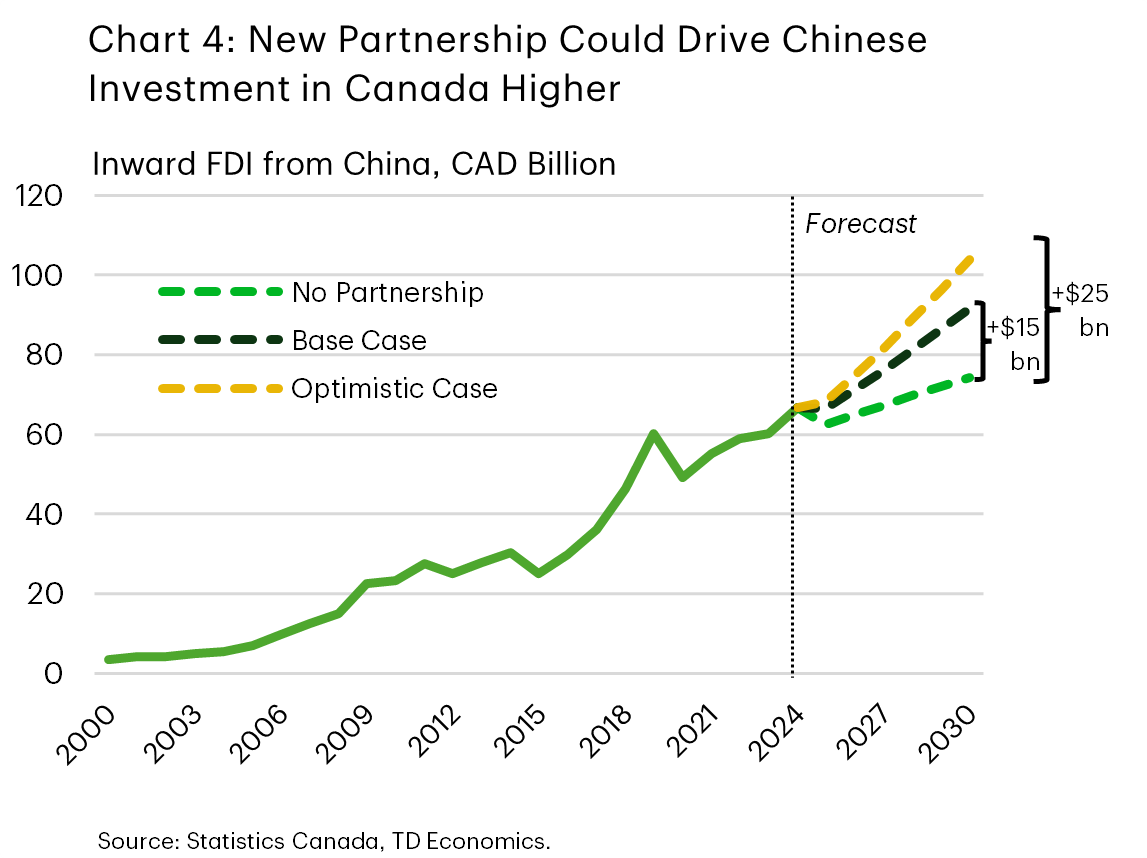

While today’s partnership may not be as transformative as the policy changes from two decades ago, China could steadily claim a larger share of Canada’s incoming investment in the coming years. Assuming total Canadian inward FDI grows at an organic 5 % annually, it’s reasonable that Chinese investment could cumulatively add another $15 billion (over the next five years) beyond what would likely occur without a new partnership (Chart 4). In this base scenario, China’s portion of total Canadian incoming FDI is projected to steadily return to 5.3%, reaching its peak level from 2019. A more optimistic, but not improbable scenario, is one where Chinese FDI growth into Canada significantly outpaces other nations, leading to upwards of $25 billion in excess investment over the next 5 years, equivalent to 6% of total inward Canadian FDI. All told, we see the stock of Chinese FDI in five year’s time being somewhere in the range of $90-100 billion, compared to Canadian total inward FDI of around $1.7 billion.

Where Could the Money Flow?

Canada’s energy sector, particularly oil and gas, forms the backbone of Chinese FDI interests in Canada (Chart 5). Existing linkages suggest that Chinese investments in oil and LNG are likely to remain robust and grow steadily over the next several years. Canada’s role as a supplier of energy to Asia (including China) has been growing with new infrastructure such as the Trans Mountain Expansion (TMX) which has allowed for a scaling up of exports to Chinese markets. Additionally, PetroChina already holds a 15% share in LNG Canada, and the recently fast-tracked LNG Phase 2 project from the Major Projects Office (MPO) offers an appealing new avenue for investment. Other noteworthy opportunities include oilsands, refining, and emerging low-carbon energy technologies.

One of the more dynamic new areas of Chinese corporate interest is the automotive and EV sector. By limiting EV tariffs to the MFN rate, Canada is demonstrating a cautious willingness to open markets to Chinese EV makers, with potential investments in manufacturing, battery, and supply-chain facilities. And we’re seeing that ball begin to roll. Chery Automobile Co., a Chinese automaker, recently reported that they are preparing to enter the Canadian EV market, indicating plans to build a full Canadian sales operation and opening offices. Similarly, Ottawa is encouraging Chinese investment in Canada’s food processing, manufacturing and agricultural research sectors. Canada’s large agricultural sector has long been under-invested in, making foreign capital (including from China) potentially more attractive.

Elsewhere, finance and insurance, professional services, and technical sectors have emerged as growing areas of Chinese investor focus, as China diversifies out of natural resources. On the finance and insurance side, this could include stake acquisitions in financial institutions, asset managers, or fintech, and partnerships in professional services. On the tech side, there’s increasing interest in investment toward higher value, innovation-driven segments like technologies linked to EVs and advanced manufacturing.

New Investment Will Not Come at the Expense of Due Diligence

The Investment Canada Act (ICA) governs all foreign direct investments in Canada and its full rule set will still apply to China regardless of recent agreements. The level of review for potential investments varies. Most investment only require a simple notification with no formal approval needed. Large acquisitions of control (above thresholds) require pre-approval under the “net benefit to Canada” test. Lastly, any investment of any size can be reviewed for national security if concerns arise.

Under the ICA, no country is categorically banned from investment, but China has historically faced heightened scrutiny of specific investments due to national security and competition concerns. For example, in 2022 , Canada adopted a policy effectively restricting investments by state-owned or state-influenced enterprises in sensitive sectors like critical minerals, disproportionally affecting China. These investments are either blocked or only allowed on an exceptional basis. Also in recent years, a disproportionate number of national security screens under the ICA involved Chinese investors. Some major Chinese investments impacted by the ICA in the past include: the blocked $1.5 billion takeover of Aecon in 2018, the forced exit of China Mobile in 2021, the blocked $230 million purchase of TMAC resources, and forced divestitures by three Chinese firms in Canadian lithium companies–among several others.

The ICA won’t be re-written because of this deal, but it may be applied differently in select circumstances. A warmer policy climate will open the door to more Chinese investment approvals in manufacturing, auto supply chains, traditional energy infrastructure. Investment vehicles like joint ventures or strategic alliances may see speedier reviews. The guardrails will be firmly in place in areas like critical minerals, AI, telecommunication, defense and data-intensive platforms, which will likely stay highly restricted.

Other Considerations: USMCA Review

Canada’s new strategic partnership with China has created friction with the U.S. administration ahead of USMCA renegotiations later this year. In a Truth Social post, President Trump threatened punitive tariffs on Canadian goods of 100% if Canada negotiates a free-trade deal (FTA) with China. Prime Minister Carney was quick to point out that this new partnership is not an FTA and Canada has no intention of pursuing a comprehensive free trade deal with China. Moreover, in a hearing before the U.S. Senate Banking Committee last week, Treasury Secretary Bessent stated that the U.S. would not remove tariffs on Canada even if Canada eliminated its own levies on U.S. goods, citing the risk of Canada being a gateway for Chinese EVs entering into the U.S. market. As the USMCA review gains steam, Canada will need to be mindful of potential downside risks to its trade relationship with the U.S. with its goals of deeper engagement with China and other trading partners.

Bottom Line

Canada’s economic and investment cooperation framework with China pushes Canada’s global positioning in the right direction. The deal should provide modest near term trade support, though meaningful investment gains may take some more time. Over the medium-term, China will likely regain more of Canada’s FDI pie, an important shift as the nation seeks to drive substantial capital flows into the country. Oil, LNG and EV related supply chains stand out as the most likely beneficiaries, while areas such as critical minerals, AI and data intensive industries remain tightly constrained. Heightened U.S. sensitivities ahead of USMCA renegotiations reinforce clear limits on how far Canada can deepen investment ties with China.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: