Highlights

- The Canadian job market has reached an inflection point. With the unemployment rate on the rise, we look to answer the question: How much further will the labour market soften?

- We map out three scenarios which can restore balance to the labour market: A perfect landing, a hard landing, and a soft landing reflective of the TD Economics Baseline forecast.

- Here we quantify path for the unemployment rate and number of expected job losses under each scenario, while explaining the various structural factors - excess savings, population growth, climate transition policies - that will act to cushion the labour market.

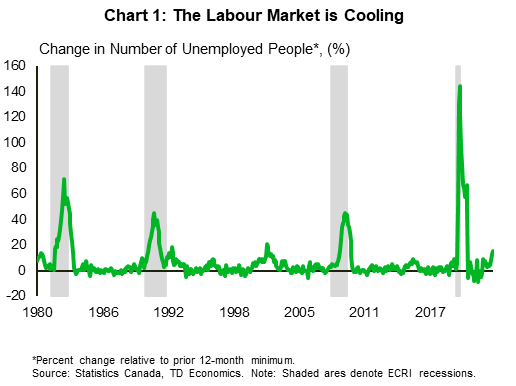

A loosening in Canada’s super-charged job market is finally underway. Hiring has slowed from a pace of 80k a month in early 2023 (three-month average), to just 12k in July. With demand slowing alongside a population-fueled increase in labour supply, the unemployment rate has jumped by 0.5 percentage points (ppts) to 5.5% and the number of unemployed workers has shot up by 123k this year (Chart 1). With these early signs of a slowdown in the labour market, the question arises: How much further will it soften?

Many Ways to Land a Plane

While an inflection point in the job market has been achieved, most benchmarks show that the labour market remains too tight. Just look at the number of job vacancies, which are well above historical averages, and wage growth, which is running at a pace nearly 2% above inflation. Further loosening is needed. By our estimates, the unemployment rate needs to reach 6% (if not higher) to bring balance to the job market.

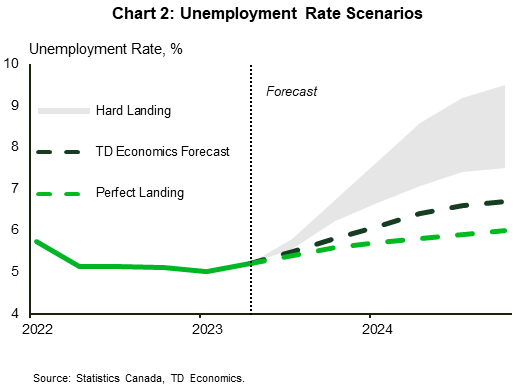

There are several ways balance can be achieved. We evaluate three scenarios, with each differing in the speed and magnitude of adjustment (Chart 2).

- A Perfect Landing (10-20% probability)

- A Hard Landing (20-30% probability)

- A “Softish” Landing - The TD Economics Baseline (50-60% probability)

A Perfect Landing

In the first scenario, the job market would continue to moderate, with the unemployment rate rising to a peak of 6%. A balanced market would be reached as labour supply rises at a quicker pace than still-firm demand for workers. This would not preclude a continued increase in the number of unemployed workers alongside falling job vacancies. Less job switching and a reduction in worker bargaining power would cause wage growth to ease. The key with this scenario is that total employment may still eke out positive but moderate net gains as firms attempt to retain employees.

While this sounds like a fairy tale scenario, one where balance is achieved without inducing substantial layoffs, it would occur at a glacial pace. By our calculations, a perfect landing would mean that balance would only be restored in the spring of 2024, with wages returning to more normal levels at the end of next year. This would keep total spending in the economy elevated, elongating the current high inflation environment. Given the high indebtedness of Canadian households and potential for growing impact on spending from past rate hikes, we have placed a relatively modest 10-20% probability on this scenario.

A Hard Landing

On the other extreme, the second scenario shows what would happen if the economy were to succumb to a deep recession, as benchmarked to a historical average of past recessions. This is a scenario, where the lags of the 475 basis points in monetary policy tightening prove longer and far more powerful than expected, a contraction in output would give way to hefty job losses and vice versa.

Over the last four decades, the Canadian economy has entered recession four times, with the unemployment rate rising by an average of 4.5 ppts (excluding the pandemic). Consistent with this spike in the unemployment rate, one could envisage a dramatic net job loss on the order of 500k (Table 1). With labour supply continuing to increase, the unemployment rate would rise to 7% to 9%. This overshoot would quickly extinguish domestic inflation pressures, but widespread job cuts would result in a lengthy recovery.

Table 1: Pathway to the TD Economics Forecast

| Average Unemployment Rate Increase in Recession* | Average Employment Decline in Recession (%)* | Expected Job Losses in Recession (Using Historical Average) | Expected Job Losses - Adjusted for Pandemic and Job Vacancies | Expected Job Losses - Adjusted for All Structural Factors | |

| Canada | 4.5% (Range: 2.8% - 6%) | 3.7% (Range: 2% - 5%) | 500k (Range: 450k - 550k) | 200k (Range: 150k - 250k) | 50k (Range: 25k - 75k) |

Still, it’s important to note that the recession average masks a wide variation of outcomes of past recessionary cycles. During the Global Financial Crisis in 2008-09, the unemployment rate rose by less than 3% compared to the 6% rise in the 1981 recession. Accordingly, we would put a wider range of probabilities around the notion that no hard landing in the past has been created equally. An upward move in the unemployment rate above 7% would be assigned 30% odds, whereas a surge to 9% receives a 20% probability.

One could argue that the labour market has changed dramatically over the years, which would lessen the risk of not only a hard landing but one akin to an average of recessions past. For one, the consensus is that volatility in unemployment has declined in recent decades around a lower trend (or steady state) level. In the 1990s, the steady state unemployment rate was considered to be in the 7% to 8% range, not the 6% level today.

However, there are other structural factors in play that are likely to mitigate against the risk of a hard landing. Canadians still have over $100bn in excess savings from the pandemic. This nest-egg will be an important buffer to smooth-out the impact of high interest rates. Additionally, the Canadian population is growing at a pace not seen since the 1950s immigration/baby boom. This will further add to labour supply and act as a demand shock to the economy – all newcomers will be consumers, which will boost spending. Both excess savings and population flows should keep overall GDP in positive territory over the coming quarters, supporting business profits, and incentivizing firms to retain workers.

Additionally, we have seen an uneven economic recovery over the last few years. There are many industries that have yet to recover in terms of employment. In Table 2, we highlight the industries that still have further to go in order to get employment back to trend. Of note are the accommodation/food services and natural resources sectors. Given that firms in these sectors have under-hired over the last few years, they will be less likely to cut workers to a similar degree as in the past. Table 2 also reveals the number of job vacancies for firms that have seen a structural improvement in demand for their products/services. Government policies directed at investment in the climate change transition and population growth have firms in various sectors continuing to seek workers. Industries such as construction, trade, transport, and health care have a long pipeline of projects and firms are likely to make all attempts to retain workers, if not add to their workforce.

Table 2: Canada Sectoral Breakdown

Table 2 is a heatmap showing how various sectors performed over various cycles. We show recessionary job losses in the 1981, 1990, 2008, and 2020 recessions, while also showing employment growth relative to the pandemic and the current level of excess job vacancies. Lower percent values are shaded in red (higher blue), while higher vacancies are shaded red (lower blue).

| 1981 | 1990 | 2008 | 2020 | Employment Growth Relative to Pre-Pandemic | Excess Job Vacancies (Thousands) | |

| Canada | -5% | -3% | -2% | -16% | 5% | 352 |

| Accommodation and food services | -2% | -4% | -4% | -50% | -8% | 33 |

| Resources | -8% | -5% | -6% | -8% | -5% | 8 |

| Utilities | -3% | 3% | -1% | -1% | 17% | 1 |

| Construction | -13% | -14% | -6% | -21% | 2% | 34 |

| Manufacturing | -16% | -14% | -8% | -17% | 6% | 14 |

| Trade | -2% | -2% | -1% | -21% | 2% | 66 |

| Transport and warehousing | -8% | -7% | -6% | -13% | -1% | 14 |

| Finance, insurance, real estate and leasing | -1% | -2% | 1% | -3% | 14% | 26 |

| Professional, scientific & technical services | -7% | 3% | -1% | -5% | 16% | 13 |

| Business, building and other support services | 2% | 4% | -4% | -14% | -10% | 2 |

| Educational services | 0% | 5% | 0% | -11% | 10% | 10 |

| Health care and social assistance | 2% | 4% | 2% | -11% | 7% | 77 |

| Information, culture and recreation | 3% | -5% | 3% | -25% | 7% | 10 |

| Other service | -2% | -2% | 2% | -26% | -3% | 13 |

| Public administration | -3% | 2% | 0% | -2% | 17% | 33 |

The Baseline View

That brings us to our TD Economics baseline, which considers the changing nature of the labour market. While still embedding the lagged impact of higher interest rates, when adjusted for structural factors, we forecast that the unemployment rate will rise to a peak of 6.7% over the next year. That’s 1.7 ppts above the 2023 low. This would be an overshoot of the level required to balance the market. As such, we anticipate net job losses, but a comparatively modest 50k, with the timing of broad job cuts likely commencing by the end of this year. We have placed a 50-60% probability on this scenario.

The Bank of Canada (BoC) has highlighted that it needs to see further loosening in the job market before it can be confident that inflation will return to the 2% target. Given the adjustment to date and our forecast for further slowing over the rest of this year, the evidence is coming. While there are currently buffers in place to prevent a hard landing, the economy is entering a delicate stage – one that will require greater attention from the BoC as it attempts to land the plane as softly as possible.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: