2026 British Columbia Budget

Managing a Wider Fiscal Gap

Marc Ercolao, Economist | 416-983-0686

Date Published: February 18, 2026

- Category:

- Canada

- Government Finance & Policy

Highlights

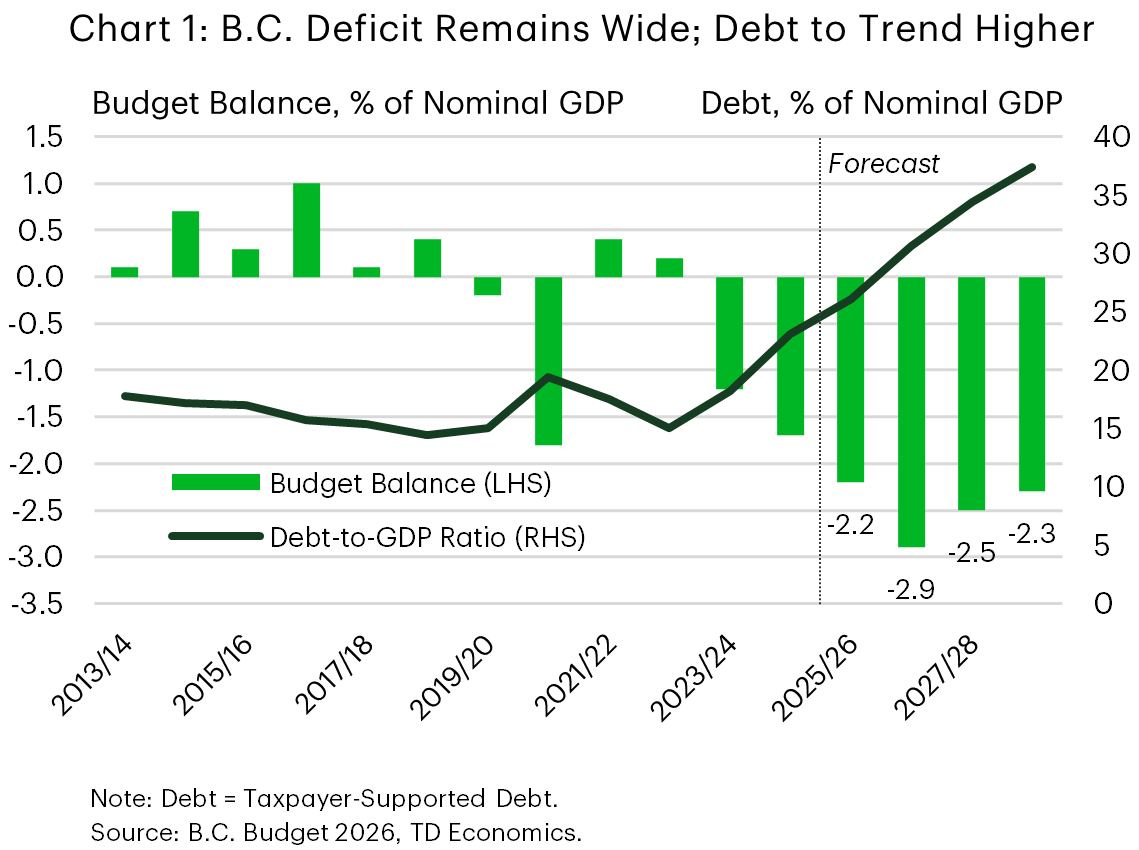

- B.C.’s budget deficit is set to widen in FY 2026/27 to $13.3 billion (or 2.9% of GDP). The projected deficit trajectory over the next three years shows only slight improvements.

- B.C.’s taxpayer-supported debt is expected to ramp up over the next three years due to ongoing deficits and an elevated capital program. The debt to GDP ratio is expected to breach 30% in FY 2026/27, before moving even higher in coming years.

The Province of British Columbia is projecting a deficit of $13.3 billion (or 2.9% of GDP) in FY 2026/27. This would represent a steep widening from the updated FY 2025/26 shortfall of $9.6 billion, albeit one that was projected at $11.2 billion as recently as the mid-year update. Over the three year planning horizon, cumulative deficits tally roughly $6 billion higher than the Budget tabled a year ago, with the annual flow of red ink expected to hold above 2%. And with only very gradual deficit reduction planned over the next few years, the province’s debt burden is set to rise steadily.

In terms of policy measures, the government announced some changes to the tax system including a 0.6 percentage point (ppt) increase to the first income tax bracket. For lower income households, the impact of the tax hike will be partially offset by an increase to the B.C. Tax Reduction Credit. Other measures include: expanding the PST tax base to include some professional services, increasing the Additional School Tax rate, increasing the Speculation and Vacancy Tax rate, and adding a new temporary 15% manufacturing and processing investment refundable tax credit1. On the spending side, the government emphasized a desire to protect core services, including health and education. Some reductions in spending will come via continued expenditure management efforts, with a focus on a leaner government through attrition.

Unlike last year’s Budget, the budget didn’t provide an explicit alternative revenue scenarios based on tariffs. Instead, the revised baseline growth estimates now factor in the current tariffs structure as of January 2026. The fiscal plan also bumps the inclusion of sizable annual contingencies to $5 billion, providing some buffer against negative surprises.

B.C. Economic Assumptions.

[Percent change unless otherwise noted]

| Budget 2026 | |||||

| Calendar Year | 2025F | 2026F | 2027F | 2028F | |

| Nominal GDP | 4.1 | 4.4 | 4.1 | 4.2 | |

| Real GDP | 1.5 | 1.3 | 1.8 | 1.9 | |

| Unemployment Rate (%) | 6.2 | 5.9 | 5.8 | 5.5 | |

| CPI | 2.1 | 2.1 | 2.0 | 2.0 | |

| Retail Sales | 5.8 | 2.4 | 3.3 | 3.8 | |

Modest Revenue Growth, Elevated Risks

Total revenue is projected to grow at a paltry 0.5% in FY 2026/27, a slowdown from the already-subdued 1.2% growth expected this year. These soft gains reflect weakening economic activity, slowing population growth, and uncertainty tied to the province’s trade picture.

Personal income tax revenue is expected to grow modestly, helped by the net impact of the new tax measures. The measures – notably the PIT change and the expansion of the provincial sales tax – are expected to raise over $500 million in the upcoming year. Although corporate income tax receipts are expected to pull-back in the upcoming year, higher natural resource revenues should provide an important offset (+17% in FY 2026/27), with higher natural gas royalties linked to rising prices and LNG related production. Looking further out, revenue growth improves to 3.5% on average over the forecast horizon but that pace still remains below its long-term average.

The government is assuming real GDP growth of 1.3% in 2026 and 1.8% in 2027. Nominal GDP (a better proxy of revenue changes) is expected to rise by 4.4% in 2026, before easing slightly in subsequent years. These assumptions are broadly in line with our view. The budget notes a number of key downside risks to the outlook, including trade disruptions, weaker consumer demand, and commodity price volatility. The budget’s fiscal sensitivities suggest that a 1 ppt swing in nominal GDP could shift revenues by several hundred million dollars annually.

Spending Maintained in Focus Areas

Total expenses are slated to accelerate by 4.4% in FY 2026/27, up from 3.6% in the past fiscal year. Healthcare, education and other social services will receive the bulk of new outlays, totaling a $2.2 billion gain for the coming fiscal year. Excluding the costs of servicing debt, program spending growth is closer to 3.1% range, still a slight acceleration from last year. Expenditure management remains a central pillar to the Budget, with projected gross saving of over $3 billion over the forecast horizon. Measures include a planned reduction of roughly 15,000 public-sector FTEs over three years, with reinvestments into core services.

Beyond this year, program spending is curtailed to around 1.0% on average over the projection horizon. At this pace, expenses relative to GDP would move lower from 21.2% to 20.4% by FY 2028/29. Note that in the decade prior to the pandemic, the spending-to-GDP ratio was under 19%.

B.C. Re-Pacing its Capital Spending Plan

B.C.’s capital plan remains large by historical standards, though its pace of growth has moderated. Total capital spending is projected to rise to $18.7 billion in FY 2026/27, up about 9% y/y, before falling modestly in the outer years. Compared with last year’s plan, the three year capital envelope is lower by about $7 billion, now totaling around $53 billion. The capital plans reflects project sequencing adjustments and the completion of several major builds. Spending continues to be concentrated on transportation infrastructure, health facilities, schools, and clean energy projects.

Ultimately, the combination of ongoing deficits and elevated capital spending is expected to drive an over 4 ppt increase in the government’s net debt-to-GDP ratio to 30.6% in FY 2026/27. Two years out, the government debt load is tracking toward 37.4% of GDP, its highest level on record. This represents a clear upward shift from pre pandemic norms, when the ratio averaged closer to the mid teens, but remains comparatively low within the provincial landscape.

Provincial borrowing is projected at $34.9 billion in FY 2026/27 (a 10% annual gain), driven by capital investment and refinancing needs. Looking ahead, borrowing is projected to hold at around $35 billion by FY 2028/29.

Perhaps most indicative of the sharp rise in borrowing is the rapid growth in debt servicing costs in the budget. By the end of the forecast horizon, debt service costs are set to reach $8.7 billion compared to $5 billion last year. The interest bite (or cents per dollar of revenue) expected to increase to 6.2 cents, up from 4.9 cents in FY 2025/26, and reaching 8.2 cents in the outer years.

Bottom Line

This budget takes some modest steps to place the B.C.’s fiscal position on a more sustainable path, including raising some taxes and curbing non-core spending particularly in the latter years of the plan. Even still, the debt burden is projected to continue to rise at a pace far outstripping GDP. This suggests that further, bolder efforts to rein in deficits may be required going forward.

B.C. Government Fiscal Position

[Millions of C$ unless otherwise indicated]

| Fiscal Year | 2025/26 Forecast |

2026/27 Plan |

2027/28 Plan |

2028/29 Plan |

|

| Revenues | 85,082 | 85,523 | 88,578 | 91,754 | |

| % Change | 1.2 | 0.5 | 3.6 | 3.6 | |

| Total Expenditures | 94,696 | 98,832 | 100,743 | 103,191 | |

| % Change | 3.6 | 4.4 | 1.9 | 2.4 | |

| Allocation for Contingencies | 4,000 | 5,000 | 5,000 | 5,000 | |

| Surplus (+)/Deficit (-) | -9,614 | -13,309 | -12,165 | -11,437 | |

| % of GDP | -2.2 | -2.9 | -2.5 | -2.3 | |

| Total Debt | 116,540 | 142,897 | 166,906 | 189,019 | |

| % of GDP | 26.1 | 30.6 | 34.4 | 37.4 | |

End Notes

- Other tax measure details: The Speculation and Vacancy Tax rate will increase for foreign owners and untaxed worldwide earners to 4% for the 2027 tax year, up from the current 3%. The Additional School Tax rates will increase from 0.2% to 0.3% for property values between $3 million and $4 million and from 0.4% to 0.6% for property values above $4 million, effective for the 2027 tax year. Expanding B.C.’s PST tax base to include professional services such as accounting and bookkeeping, architectural, geoscientist and engineering services, commercial real estate fees and security and private investigation services – this change generally aligns B.C. with how other provinces apply sales taxes to these services. Adding a new temporary 15% manufacturing and processing investment refundable tax credit for businesses investing in buildings, machinery and equipment used in manufacturing and processing.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: