Notes

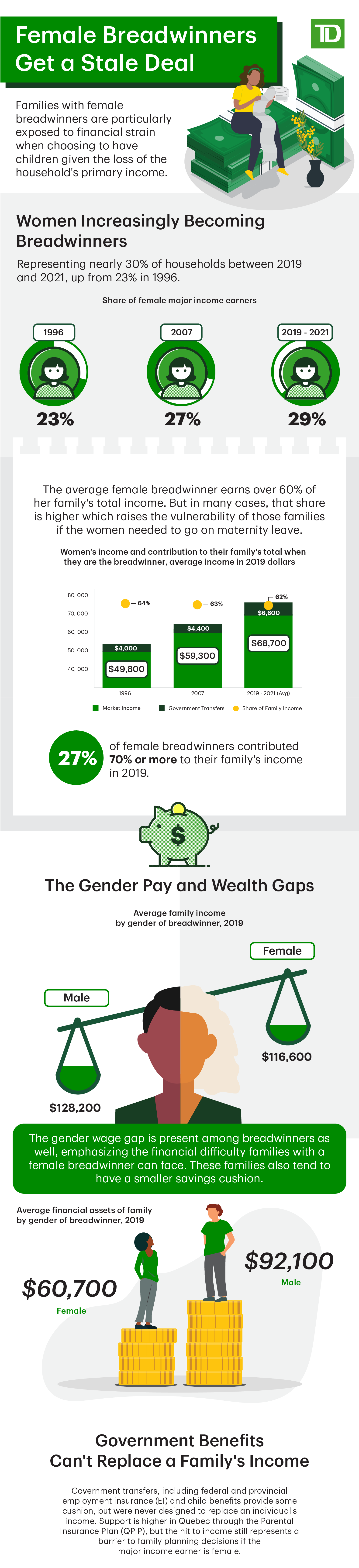

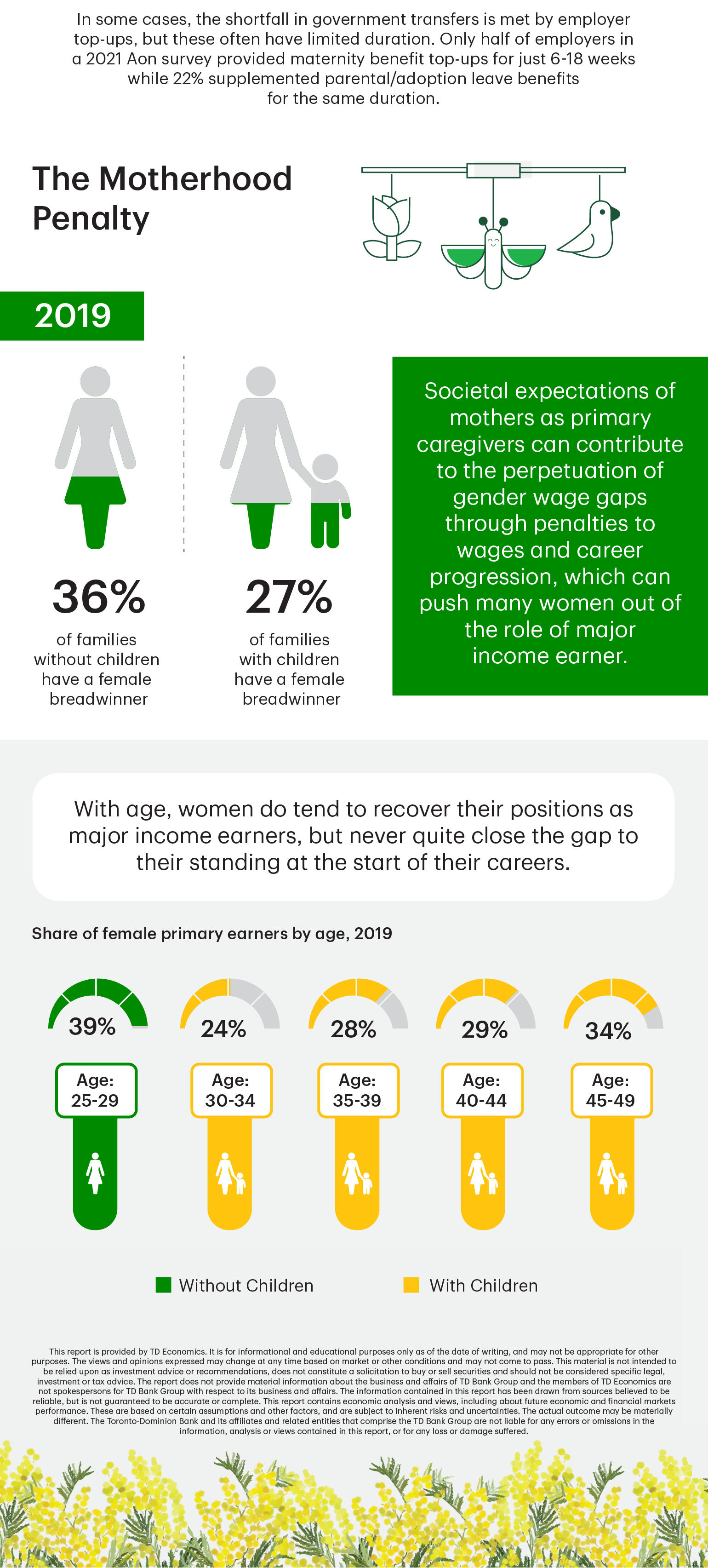

- Income data draws from non-elderly couple economic families with 25–44-year-old females and/or all major income earners in the same age group, unless stated otherwise.

- Child benefits for the couple's child(ren) have been evenly split between the couple.

- Financial assets include registered retirement income funds, RRSP investments including locked in RRSP's, non-registered: bonds, money in banks, mutual funds, other investment/financial assets, income trusts, stocks and shares, and TFSAs for couple and lone-parent economic families where the major income earner is 25-44 years of age.

- For the chart showing maternity/parental/child benefits, the employment earnings is calculated for an average female breadwinner without children and government transfers estimate what she would get over a one-year maternity plus parental leave for her first child.

Sources: Aon Rapid Response Survey - Supporting Families at Work: Maternity and Parental Top-up Trends (2021), Canada Revenue Agency, Government of Quebec, Statistics Canada - Canadian Income Survey: Public Use Microdata File (2019, 2020, 2021), Survey of Financial Security: Public Use Microdata File (2019), Survey of Labour and Income Dynamics (1996, 2007).

Download

Share: