Federal Budget 2024 Preview

Restraint in the Time of Inflation

Francis Fong, Managing Director & Senior Economist

James Orlando, CFA, Director & Senior Economist | 416-413-3180

Date Published: March 14, 2024

- Category:

- Canada

- Government Finance and Policy

Highlights

- Budget 2024 is expected to show that the federal government remains on track to meet its fiscal targets set in 2023. Despite program spending so far this year coming in far hotter than previously anticipated, the deficit in FY 23-24 is expected to be limited to $40 billion.

- In terms of new spending measures, pharmacare is likely to be the centerpiece. While the program will start with diabetic medication and contraceptives, its ultimate budget impact hinges on the extent to which the program is expanded.

- Beyond pharmacare, new budget measures are likely to be scant, with firepower being reserved for next year’s pre-election budget. The remaining focus will likely be on continuing to raise housing supply and address the cost of living. No major tax measures are expected to be unveiled, though government will likely continue to tout previously announced changes, including to the alternative minimum tax.

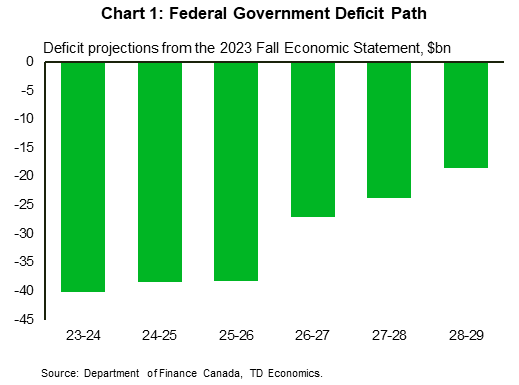

In the 2023 Fall Economic Statement (FES), Finance Minister Freeland committed to two new fiscal objectives: keeping the budget deficit for FY 2023-24 at or below $40 billion and reducing the deficit on the way to capping its size to 1% of nominal GDP by 2026-27. Recent communications from the government suggest that these targets will be maintained in Budget 2024, implying little change in the projected deficit and debt paths (Chart 1).

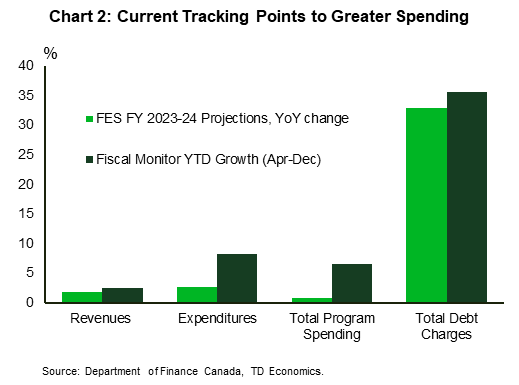

Monthly data, however, show that government expenditures have been coming in far hotter than anticipated just 3 months ago, with our tracking of the deficit being closer to $55 billion than $40 billion (Chart 2). There is time for the government to iron out some of its fiscal loose ends before the Budget is presented on April 16th, and year-end adjustments are expected to swing in the government’s favour. Aiding this will likely be a boost to government revenues as economic growth and inflation have come in higher than anticipated. Importantly, this tailwind is expected to carry through to fiscal 2024-25, which should grant the government some additional near-term fiscal space to implement new policy in Budget 2024.

Still, don’t expect Budget 2024 to be big in terms of new spending commitments, especially in light of Minister Freeland’s recent guidance around ‘creating the conditions’ for interest rates to fall. Accordingly, we expect the government to direct any extra fiscal wiggle room towards a few high priority areas – addressing housing/affordability and setting the foundation for national pharmacare.

Stronger Nominal Growth Juicing Fiscal Coffers

The government’s fiscal outlook has improved in recent months (Table 1). With improved economic data to close 2023, expectations for real GDP growth for 2024 have been nudged upward. At the same time, inflation has remained stubbornly high and is expected to remain elevated through the first half of 2024. This will contribute to an improvement in nominal GDP growth (real GDP + inflation), which will likely cause government revenues to be upgraded for fiscal years 2023-24 and 2024-25. Using budget sensitivities1, TDE’s forecast outperformance in nominal GDP growth (roughly 2 percentage points) relative to the assumption in the Fall Economic Statement (FES) would yield an extra $5-to-10-billion in fiscal space for the upcoming year. Beyond that, the tailwind to government revenues from stronger economic growth is expected to gradually fade. While real GDP growth should be coming in around its trend pace, 2025 should see inflation return to the 2% target. This will result in nominal GDP growth and, in turn, government revenues landing below that assumed in FES.

Looking to the opposite end of the accounting ledger is the growing impact of high interest rates. In fiscal 2023-24, public debt charges have been the largest growing government expenditure. This trend is expected to continue into the upcoming fiscal year, but the pace of growth will decelerate as the BoC pivots to cutting interest rates starting at mid-year. Relative to the FES assumptions, however, TDE’s current forecast on yields is virtually in line for this year, with a modest 30- to 40-basis point undershoot anticipated in the outer years of the budget forecast. That would translate into a roughly $1 billion improvement in the bottom line beginning in FY 25-26 compared to estimates in the FES.

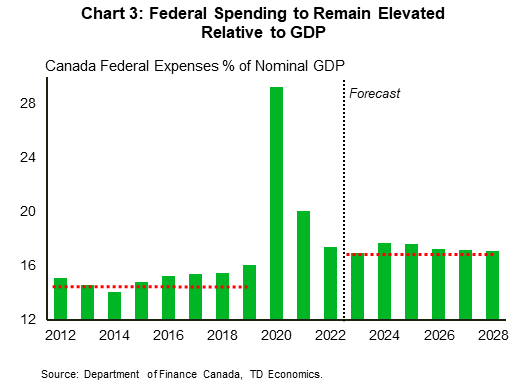

All told, the improvement in the near-term growth outlook since the autumn will likely provide more wiggle room to budget planners, but only modest. And it is yet to be seen how the federal government will ultimately offset the higher-than-expected spending witnessed so far this year (Chart 3).

What new to expect in Budget 2024

The evolution of the government’s economic priorities has shifted throughout the pandemic and the subsequent recovery. In Budgets 2021 and 2022, the focus was on supporting jobs and small business expansion. In Budget 2023, growing the green economy came to the forefront. But one consistent theme since the rise of inflation in 2022 has been on making life more affordable for Canadians through GST relief, etc. In the 2023 Fall Economic Statement, the government expanded that to address housing shortages.

Budget 2024 looks to build on past efforts, with a focus on affordability via a nationwide pharmacare program and efforts to improve housing affordability. While these are big objectives, the added fiscal room from higher revenue growth will only afford the government an opportunity to make modest spending commitments.

Pharmacare: the Start of Something Big?

The federal Liberals and the New Democrats have reached a deal on a nationwide pharmacare plan as part of their confidence-and-supply arrangement. This is expected to cost approximately $1 billion per year and will likely be rolled out before the next election. We await further details, but the first reading for bill C-64 sets out commitments to create a national formulary and bulk purchasing strategy, with the aim providing first-dollar coverage starting with contraceptives and diabetes medications. This will be one of the most heavily critiqued budget items given the cost, which will challenge the government’s priority of fiscal responsibility. Still, the total amount expected to be spent is less than what would have occurred under a universal pharmacare program. While $1 billion a year price tag has been the number leaked in the media, estimates will vary. Key to the fiscal outlook, however, will be to what extent the program is expanded in the future. According to the Canadian Institute for Health Information, annual private drug expenditures in 2021 totaled $27 billion. The $1 billion annual spend expected barely scratches the surface, which tracks with why only contraceptives and diabetes medications are covered. How additional drug coverage evolves through the government’s forecast window will move the needle on the deficit.

Housing, Housing, Housing

Affordability has been a major focus for the government, with the prior FES taking action to accelerate the construction of new housing. The government has already established the Tax-Free First Home Savings Account and enhanced GST rebate on purpose-built rental properties. These policies have set a strong foundation for the government to execute on this priority. We don’t expect much more spending on this front, but do foresee some smaller initiatives to be announced. For example, the Canada Greener Homes Grant to incentivize Canadians to invest in green home renovations (heat pumps for example) is rumored to be extended. While the past program was open to Canadians at all income levels, an updated program is expected to focus on helping lower income homeowners and renters. If this policy is in the budget, it would help to address both housing affordability and the green transition. Importantly, it has already been announced that the government’s first-time home buyer incentive program with CMHC has been discontinued due to low uptake. We would not expect any new policy to support housing demand, but rather on supply.

Clean Energy Transition Takes a Back Seat

On the climate front, given the large number of previously announced tax credits and regulations still in flight, new initiatives are unlikely. Just as in the U.S., implementation will continue to be the key focus and we anticipate an update on ongoing legislation including for bill C-59, which specifies investment tax credits available for clean technology manufacturers and for carbon capture, utilization and storage technologies, and a review of public consultation on the clean electricity regulations and the recent hard cap on oil & gas sector emissions. A big question mark surrounds how the federal government may or may not make additional concessions on the beleaguered federal fuel charge. Several commentators already consider the heating oil exemption for Atlantic Canada to be the death knell for carbon pricing in its entirety, but this misses the forest for the trees. The federal government has far more tools at its disposal to continue pricing greenhouse gas emissions even in the absence of the fuel charge, including industrial pricing schemes, regulation and even through the new Canada Growth Fund through carbon contracts-for-difference. But more to the point, government has shown little appetite to eliminate the fuel charge completely because that would drastically lower the emissions coverage of the Greenhouse Gas Pollution Pricing Act, begging the question, why bother? In our view, a more effective strategy would be to double down on the fuel charge, while being clearer through communication on what the fuel charge is meant to do – it will make things more expensive, but the proceeds are returned directly to Canadians through quarterly climate action incentive payments, with the goal of all of this being to change the relative price of activities that emit greenhouse gases.

It is also expected that the budget will build on past policies related to the rollout of the recently established dental program. It can also focus on its efforts to adjust Canada’s immigration system, which has been moving at a pace faster than the country’s infrastructure can keep up. While sweeping policy changes here are unlikely, the government needs to strike the right balance between cost and effectiveness.

Government Challenged to Raise Productivity and Living Standards

In terms of improving Canada’s longer-term fiscal outlook, we’d argue that productivity-enhancing policies would pay dividends in terms of future economic growth/tax revenues. We suspect that given the accelerated decline in Canadian productivity in recent years, the federal government will allocate significant space in the budget towards what it has been doing to improve the nation’s performance on this front. This includes promotion of private-sector and infrastructure investment. One recent leak has been a continuation of efforts to motivate Canadian pension plans to invest more in Canada. While greater investment is a good thing, we’d expect the government will use incentives for investment rather than making it an obligation, which would compromise the pensions’ fiduciary duties. There have also been calls on the government to increase investment in city infrastructure, such as roads and water treatment. We expect the government to touch on this, but the budget allocation will not be large as there are already ongoing commitments on this front.

There is speculation – particularly within the business community – that the government may forge ahead with new taxes in order to fund new commitments and/or further shore up the nation’s fiscal position. A number of recommendations were put forth by the House Standing Committee on Finance (FINA) based on public consultation, which would both add and subtract from the revenue ledger. These include expanding the 2% tax on share buybacks, the introduction of a wealth tax, and the introduction of an excess profits tax on industries that “contribute to Canadian inflation” such as oil & gas and grocery stores and, of course, the perennial suggestion to conduct a review of the tax system.

While the government will always keep its cards close to its chest ahead of budget day when it comes to tax changes, a few factors mitigate the risk that it will go down this path. First, Minister Freeland has already signaled that Budget 2024 will remain relatively constrained in terms of new spending measures. This approach – taken together with an improved near-term economic outlook – reduces the odds that it will need to lean on significant new revenue-raising measures. Second, raising taxes would run counter to the goal of raising productivity and living standards by distorting incentives further.

The other option at the government’s disposal to boost its longer-term fiscal position is to secure efficiencies in departmental spending. In Budget 2023, it announced a target to find $15 billion in efficiencies over 5 years. Even recent efforts to support Canadian housing in the 2023 FES saw these costs pushed back to future years. This provided the government with near-term fiscal space. Further efforts to secure savings in lower-priority areas could be announced in Budget 2024 in an effort to show greater focus on fiscal management and to set the conditions for rates to come down. Given the rapid growth of Canada’s public debt costs and planned pharmacare spending, this effort could prove an important counterweight. Fiscal anchors could also be used to build confidence given the government’s effective abandonment of its debt-to-GDP anchor.

Bottom Line

The federal government is set to present a slimmed down budget on April 16th, as it focuses on greater fiscal prudence following years of heavy spending. The current fiscal year deficit is expected to come in at the government’s $40 billion estimate from the FES, even though current tracking shows that spending has run well ahead of the pace expected just a few months ago. Strong nominal GDP growth has given the government a helping hand, and it is estimated that the improved economic outlook will give the government between $5- to $10-billion in fiscal space. While this isn’t a gamechanger, it will allow the government to execute on several of its policy objectives without needing to tap significant new tax measures. The focus of the government’s objectives in Budget 2024 will be on the initiation of a national pharmacare program, addressing affordability issues related to housing, and improving Canadian productivity.

Table 1: Economic Assumptions

Annual Percent Change (Unless Otherwise Indicated)

| Calendar Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

| Real GDP | ||||||

| TD Economics Forecast | 1.1 | 0.8 | 1.6 | 2.0 | 2.0 | 1.9 |

| Economic and Fiscal Update 2023 | 1.1 | 0.4 | 2.2 | 2.4 | 2.2 | 2.0 |

| Budget 2023 | 0.3 | 1.5 | 2.3 | 2.2 | 1.9 | - |

| Nominal GDP | ||||||

| TD Economics Forecast | 2.7 | 4.5 | 4.0 | 4.1 | 4.0 | 3.9 |

| Economic and Fiscal Update 2023 | 2.0 | 2.4 | 4.3 | 4.5 | 4.3 | 4.2 |

| Budget 2023 | 0.8 | 3.6 | 4.3 | 4.1 | 3.9 | - |

| Unemployment Rate (%) | ||||||

| TD Economics Forecast | 5.4 | 6.3 | 6.6 | 6.2 | 5.9 | 5.9 |

| Economic and Fiscal Update 2023 | 5.4 | 6.4 | 6.2 | 5.9 | 5.8 | 5.7 |

| Budget 2023 | 5.8 | 6.2 | 6.0 | 5.7 | 5.7 | - |

| 3-Month Treasury Bill Yield | ||||||

| TD Economics Forecast | 4.7 | 4.4 | 2.7 | 2.3 | 2.3 | 2.3 |

| Economic and Fiscal Update 2023 | 4.8 | 4.3 | 2.9 | 2.7 | 2.6 | 2.6 |

| Budget 2023 | 4.4 | 3.3 | 2.6 | 2.4 | 2.4 | - |

| 10-Year Gov't Bond Yield | ||||||

| TD Economics Forecast | 3.4 | 3.4 | 3.0 | 2.9 | 2.9 | 2.9 |

| Economic and Fiscal Update 2023 | 3.3 | 3.3 | 3.1 | 3.2 | 3.2 | 3.3 |

| Budget 2023 | 3.0 | 2.9 | 3.0 | 3.1 | 3.1 | - |

End Notes

- A 1-percentage point decrease in real GDP reduces the budget balance by $4.9 billion in year 1, while a 1-percentage point decrease in GDP inflation reduces it by $2.3 billion. A 100-basis point increase in interest rates reduces the budget balance by $4 billion in year 1.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: