The Global Pandemic & Inequality:

It's Worse Than You Think

Sohaib Shahid, Senior Economist | 416-982-2556

Date Published: February 4, 2021

- Category:

- Global

- Global Economics

Highlights

- The pandemic has exacerbated existing inequalities across the major advanced economies (AEs), while giving birth to new ones. Women, youth, minorities, immigrants and the low-income and low-skilled have been the biggest victims of this pandemic.

- The progress made towards women's empowerment, economic inclusion and poverty reduction in AEs has been brought to a screeching halt – at least temporarily – by this crisis. This poses a significant downside risk to productivity and potential growth going forward.

- Worse still, the rise in inequality risks fuelling further increases in social unrest, populism and political polarization around the world.

"An imbalance between rich and poor is the oldest and most fatal ailments of republics", said Plutarch, the Greek philosopher, historian and essayist. His words hold true today more than ever before. History books will remember the ongoing pandemic for many things, but especially how it has exacerbated existing inequalities and given birth to new ones. The pandemic has also brought to a screeching halt – at least temporarily – the progress made in advanced economies (AEs) towards women's empowerment, economic inclusion and poverty reduction.

While previous pandemics and recessions have been known to exacerbate inequalities, the magnitude of this recession and its unique nature means that the impact on inequality will be much worse this time round. Women, youth, minorities, immigrants and the low-income and low-skilled have been the biggest victims of this pandemic. An increase in jobless youth in a world of rising inequalities could be a recipe for social unrest, political polarization and populism. In this note, we explore some of the different facets of pandemic-induced inequality across major AEs. Given the relative richness of available data, our focus is on developments in Canada, the U.S. and the European Union (EU).

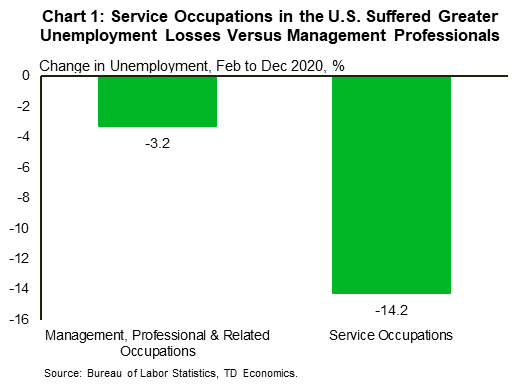

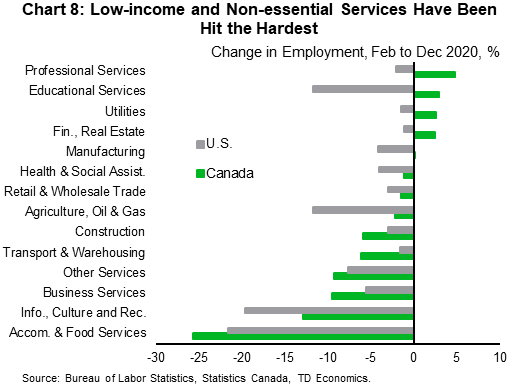

The services sector has remained in the line of fire

The pandemic's burden has fallen unevenly across sectors. One of the unique things about this crisis is its disproportionate impact on the services sector. Given the infectious nature of the virus, the services sector – especially the consumer facing services sector – has been the first victim of government lockdowns. While recessions usually take a toll on the manufacturing sector (with services playing the more supportive role), this pandemic has instead wreaked havoc on the services sector. Therefore, job losses have mostly been concentrated in the services sector (Chart 1). And since women, minorities, immigrants and low-skilled labor make a large chunk of the services sector employment, they were the first to go. They will also likely be the last to be re-employed, since high-touch service sectors are going to be the last to reopen.

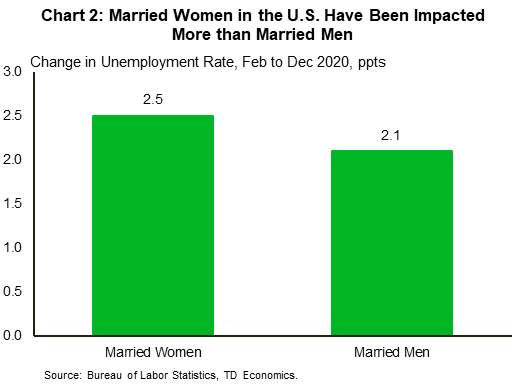

The She-cession Has Thrown Back Progress Made Towards Women's Empowerment

"She-cession" is an apt term to describe this recession and for good reason.1 While the 2008-09 global financial crisis mostly hit men, this crisis has disproportionately impacted women. Female employment is often concentrated in high touch sectors such as hospitality, childcare, restaurants and entertainment. These are also the sectors hit hardest by the pandemic, leaving millions of women without jobs. Stay-at-home orders have led to a sharper drop in mobility for women than men, especially when schools and daycares are closed.2 These measures have kept children home, leading to an increased burden on women with children compared to men with children (Chart 2). This suggests that women carry a disproportionate burden in parenting children, which has prompted them to drop out of the labor force or reduce their work hours. This has hurt not only their short-term employment but also their long-term employment prospects.

Since the pandemic's onset in Canada, the employment rate (share of the adult population holding jobs) among women has decreased by 2.7 percentage points (ppts) compared to 2.4 ppts for men (Table 1). This is still better than March last year when women's employment dropped by 4 ppts while men's employment dropped by only 2.5 ppts. Despite the improvement, women's employment rate last year stood at an almost 25-year low of 54%. Furthermore, the pandemic has exacerbated the structural gap between employment rates for women and men that has pre-existed for decades. For example, women's employment rate in Canada, which was already 7.7 ppts lower than men in February (right before the pandemic hit), is now 8 ppts lower. As for the unemployment rate, women's unemployment in Canada has increased by 3.2 ppts compared to 3 ppts for men. Likewise, since February 2020, female labor force participation rate has dropped by 0.8 ppts, compared to 0.4 ppts for men. And while women's participation rate has improved since the lows seen in April, it is once again deteriorating due to renewed lockdowns. Women's participation rate is currently 9 ppts lower than men's and at its lowest point in 20 years.

Table 1: Comparison of Labor Market Outcomes in Canada, U.S., and Europe

| Change (ppts), February to December | Employment | Unemployment | Labor Force Participation | |||

| Women | Men | Women | Men | Women | Men | |

| Canada | -2.7 | -2.4 | 3.2 | 3.0 | -0.8 | -0.4 |

| U.S. | -3.6 | -3.9 | 3.3 | 3.2 | -1.9 | -1.8 |

| European Union | -0.9 | -0.9 | 1.2 | 0.8 | -0.5 | -0.5 |

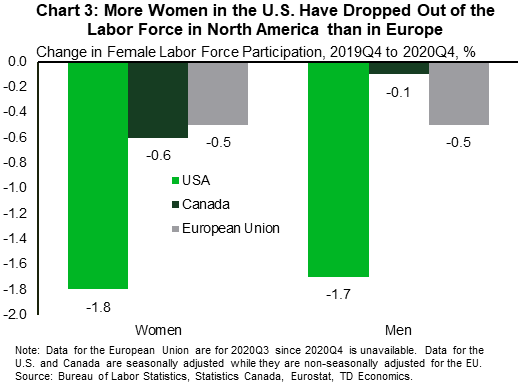

In the U.S., since February 2020, the women's employment rate has dropped less than men. However, it is important to note that women's employment was already much lower than men's going into this crisis. For example, in February 2020, men's employment rate was 66.8% while women's employment rate was 55.8% – an 11 ppts difference. As for the unemployment rate, since February, women have seen a 3.3 ppt drop compared to 3.2 ppt for men. This is still better than the peak period (April 2020) when women's unemployment jumped to 16.1% while men's unemployment jumped to 13.6%. In December, U.S. employers cut 140,000 jobs, with women losing 156,000 jobs and men gaining 16,000 jobs. In other words, women accounted for 100% of the U.S. labor market's 140,000 lost jobs. The decline in women participation rate since February doesn't look too different from men's. However, upon closer inspection, we see that women's pre-crisis participation rate was almost 12 ppts lower than men's, and still is. In fact, women's labor force participation in the U.S. has dropped to its lowest point since 1987!

Meanwhile, partly thanks to European countries' more family friendly policies and prioritizing reopening of schools, European women have fared better in the labor market compared to their North American counterparts, especially Americans (Chart 3). While European women have seen a greater increase in unemployment than men, the drop in the employment rate and labor force participation has been the same for both women and men. But once again, the devil is in the details. Women's employment is still 11 ppts lower than men's, while labor force participation is 13 ppts lower. Therefore, it is important to account for the historical gaps between women and men's employment and labor force participation rates and interpret the data by not only looking at the changes but also the levels.

All of this only describes the here and now. Going forward, women are also more likely than men to lose their jobs due to pandemic-induced automation as they often work in jobs that are more susceptible to automation, such as retail sales or clerical work.3 Gender pay gaps – which were shrinking before the pandemic's onset – are also likely to widen again.

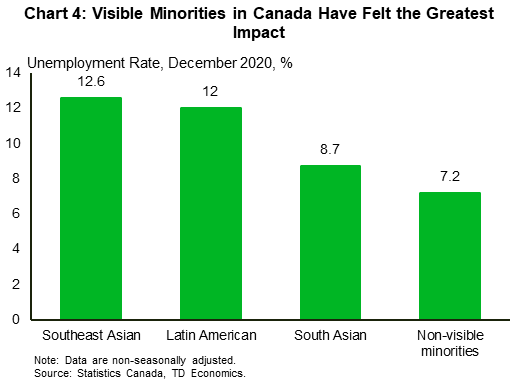

Immigrants And Visible Minorities Have Paid The Price

No surprises here. Visible minorities have borne the brunt of this crisis. Lockdowns across the world have primarily targeted the services sector. And since minorities and immigrants make up a large share of the services sector workforce, they have led the ranks of the unemployed. Immigrants and minority groups are also at an increased risk of COVID-19 infection and mortality.4 This is for several reasons. They, on average, suffer higher poverty rates and live in socio-economically disadvantaged neighborhoods. Furthermore, immigrants and minorities are more likely to live in overcrowded housing and are disproportionately represented in sectors with greater exposure to the virus. This has also meant a higher death rate for immigrants and minority communities.

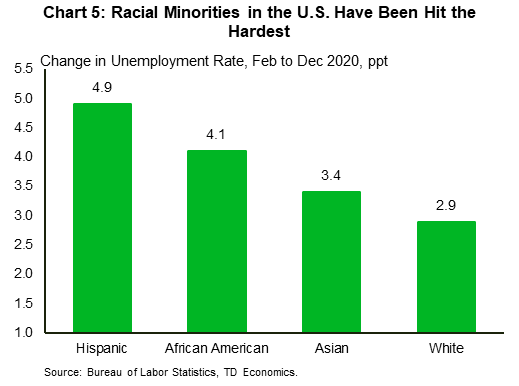

Take Canada as an example. Visible minorities currently have an unemployment rate of 9.9% compared to 7.2% for non-visible minorities (Chart 4). Meanwhile, in the U.S., since February last year, the unemployment rate for Hispanics and African Americans has jumped by 4.9 ppts and 4.1 ppts, respectively (Chart 5). This is in stark contrast to the overall increase in the unemployment rate, which was only 3.2 ppts. Still, this is better than April last year, when the unemployment rate for Hispanics and African Americans jumped by 14.5 ppts and 10.9 ppts.

Last year, social unrest increased in the U.S. in the form of protests against institutional racism and racial inequality. Since the pandemic has exacerbated racial inequalities, the risk of more widespread and protracted protests has increased. This could hurt economic and business sentiment and further weigh on economic activity. Greater social unrest has the potential to hinder recovery as it can complicate the political economy of reforms, stifle medium-term economic growth and the sustainability of government finances.

Wasted Youth?

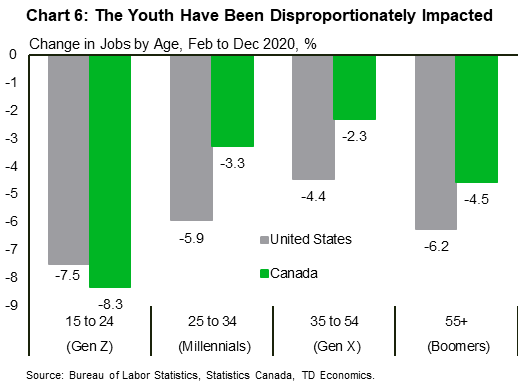

The pandemic has also dealt a disproportionate blow to youth job prospects. The so-called Generation Z – aged 15 to 24 – have by far shed the most jobs during this crisis, in part due to their higher concentrations in service and sales occupations (see report). Today's youth are also entering the labor force at a tumultuous time. Entering the job market during an economic downturn can have long-lasting effects on lifetime earnings, which can lead to sizeable gaps in income relative to the luckier cohorts.5 The disproportionate impact on younger workers could also widen inter-generational inequality. Still, to the extent that impacted youth focus on achieving higher education levels and skill-building, long-term scarring would be mitigated.

Stateside, Gen Z's employment declined by 7.5% while millennials – aged 25 to 34 – only saw a 5.9% decline (Chart 6). We notice a similar trend for Canada. Gen Z employment dropped by 8.3% in Canada while that of millennials dropped by only 3.3%. Across the pond in the old continent, the picture is even bleaker. European youth (aged less than 25 years) unemployment – already 14.9% going into the crisis – has now increased to 17.7%, an increase of 2.8 ppts. This is in stark contrast to the overall increase in unemployment which only edged up by 1 ppt.

The Low-Skilled And Low-Income In Double Jeopardy

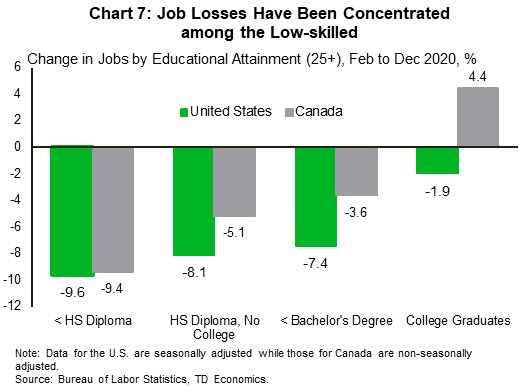

Major epidemics over the past century have raised income inequality and hurt employment prospects for those with basic education, while only marginally impacting those with advanced degrees.6 And this pandemic – one of the biggest in recent history – is even worse, as restrictions and lockdowns have disproportionately impacted the most vulnerable segments of the population. The pandemic has already increased the chasm between the low-skilled and the high skilled. In fact, the data clearly show that the fewer the years of education, the greater the adverse impact of the virus.

The pandemic has accelerated digitization and automation, both of which have been crucial in allowing industries to adjust to the COVID-19 shock (see report). However, the improvement in technology via digitization and automation are a threat to low-skilled workers, especially those working in the services sector. In fact, the pandemic might allow skilled workers to become even more productive by allowing them to work with new and improved technology. Meanwhile, low-skilled workers would have to upgrade their skills, but since acquiring new skills takes time, it isn’t something that is likely to happen in the near-term. So in a way, low-skilled workers are being squeezed from two sides; first, they are experiencing disproportionate job/income losses compared to the high skilled; second, the high-skilled are likely to become more productive and generate more income as they work with better technology.

Since the pandemic's onset in the U.S., those with less than a high school diploma have lost 9.6% of their jobs (Chart 7). Meanwhile, those with a high school diploma have lost 8.1% of their positions. This is in stark contrast to those with a college degree who have only lost 1.9% of their jobs. Similarly, in Canada, those with less than a high school degree have lost 9.4% of their jobs while college graduates have seen an increase of 4.4%. It seems that having a college degree has acted as a buffer against the virus. Since February, job losses are also concentrated in the low-income and non-essential services sectors where a large-proportion of the low-skilled are employed (Chart 8).

Low income jobs have also been hit harder by lockdowns due to their low tele-workability. Those with low tele-workability also tend to be the more economically vulnerable.7 These are also the workers that work in the hardest-hit occupations and sectors.

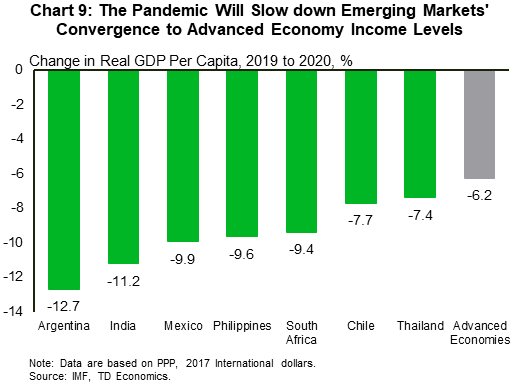

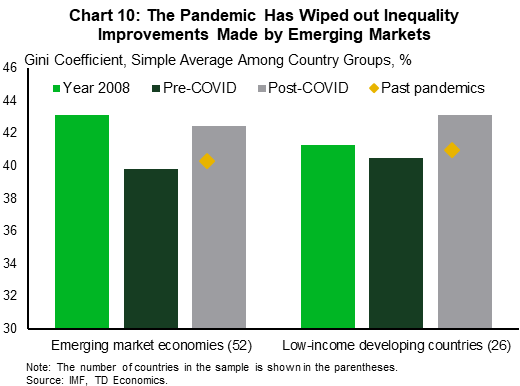

It Will Now Take Longer For Emerging Markets To Catch Up To Advanced Economies

The pandemic's global reach means that it won't just increase inequality within a country but will also increase inequalities across countries. The economic disruptions caused by the pandemic will considerably slow down emerging markets’ (EMs) “catch-up” to AEs and lead to a greater divergence in per capita incomes. In fact, the divergence is already becoming evident (Chart 9). The pandemic could also wipe out the inequality improvements EMs have made since 2008, with China being an exception (Chart 10).8 It will also push a large share of the EM population – especially that of low-income countries like Bangladesh, Sudan and Haiti – further into poverty (see report). According to the World Bank, the pandemic could push as many as 150 million people into extreme poverty by the end of this year, wiping out all the progress made in recent years. In fact, incidence of extreme poverty has risen for the first time in two decades

Rising Inequality Is A Ticking Time Bomb

Inequality isn't a new problem. The pandemic has simply turbocharged it. The rise in income and wealth inequality – especially among the youth – provides for the perfect breeding ground for social unrest, populism and political polarization (see report). These factors combined also have the potential to accelerate deglobalization (see report). High inequality levels are likely to keep growth depressed through weak aggregate demand and slower productivity growth.

Previous pandemics have been followed by an increase in social unrest.9 And this time isn't different. In fact, lockdown-related protests have already rocked countries like Germany, Mexico and the UK. Social unrest may intensify going forward, due to higher inequality and unequal access to vaccines and therapies in certain parts of the world. And since social unrest can lead to lower growth, it can further exacerbate inequality, leading to a vicious cycle of higher social unrest and higher inequality. Once countries are stuck in this vicious cycle, it will be difficult for them to break free.

Bottom Line

The pandemic has engulfed the whole world, but its impact has been felt unequally. It has exacerbated existing inequalities and given birth to new ones. The virus has disproportionately hit women, minorities, immigrants, youth, and the low-skilled and low-income. It has also brought to a screeching halt – at least temporarily – the progress made towards improved women's empowerment, economic inclusion and poverty reduction. These factors combined will lower productivity, decrease potential growth, and make economic growth less inclusive. The rise in income and wealth inequality – especially among the youth – may give way to an increase in social unrest, populism and political polarization. Governments need to urgently go on war-footing to tackle the surging inequality. Even if socio-economic consequences of high inequality haven't fully manifested themselves yet, data suggest that the time to act is now. Let's not wait for inequality to rear its ugly head.

End Notes

- Armine Yalnizyan first dubbed the ongoing crisis as a "she-cession" in March 2020 (https://www.cbc.ca/radio/thecurrent/the-current-for-march-30-2020-1.5514566/mar-30-2020-episode-transcript-1.5515476

- IMF WEO October 2020 (https://www.imf.org/en/Publications/WEO/Issues/2020/09/30/world-economic-outlook-october-2020)

- Frank, Kristyn, and Marc Frenette "Automation and the Sexes: Is Job Transformation More Likely Among Women." September 24, 2020 (https://www150.statcan.gc.ca/n1/en/pub/11f0019m/11f0019m2020015-eng.pdf?st=R79V0P_s)

- https://www150.statcan.gc.ca/n1/pub/11-631-x/2020004/s6-eng.htm

- Oreopoulos, Philip, Till von Wachter, and Andrew Heisz. 2012. “The Short- and Long-Term Career Effects of Graduating in a Recession.” American Economic Journal: Applied Economics, 4 (1): 29 (https://www.aeaweb.org/articles?id=10.1257/app.4.1.1)

- https://www.aeaweb.org/articles?id=10.1257/app.4.1.1

- Brussevich, Mariya, Era Dabla-Norris and Salma Khalid. 2020. "Who will Bear the Brunt of Lockdown Policies? Evidence from Tele-workability Measures Across Countries." IMF Working Paper, WP/20/88.

- Cugat, Gabriela and Futoshi Narita. "How COVID-19 Will Increase Inequality in Emerging Markets and Developing Economies." IMF Blog, October 29, 2020 (https://blogs.imf.org/2020/10/29/how-covid-19-will-increase-inequality-in-emerging-markets-and-developing-economies/)

- Saadi Sedik, Tahsin and Rui Xu. "When Inequality is High, Pandemics Can Fuel Social Unrest." IMF Blog, December 11, 2020 (https://blogs.imf.org/2020/12/11/when-inequality-is-high-pandemics-can-fuel-social-unrest/)

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: