China: Where Things Stand

Andrew Hencic, Senior Economist | 416-944-5307

Date Published: March 5, 2024

- Category:

- Global

- Asia

- Global Economics

Highlights

- The current economic situation is best characterized by the nagging ripple effects from the overhang in the housing market.

- A quick revival in China’s economic prospects that can quickly mop-up lingering capacity and restore consumer confidence is unlikely given policymaker hesitancy towards large-scale stimulus.

- Excess capacity in China will act as a release valve for goods prices in advanced economies. For advanced economies, ongoing deflation could help relieve the inflationary fever.

China’s economic challenges linger – despite fiscal stimulus introduced towards the end of last year. This is consistent with the trends we pointed out were worth watching last fall, to gauge how the economy handled its excess capacity and the drag from the property market. As it stands, limited progress has been made on either front. Cuts to the Loan Prime Rate (LPR) and reserve requirement ratio look to add liquidity to the market, but downbeat sentiment and weak price pressures are acting as a drag on credit demand.

Looking forward, the GDP growth target for 2024 has been set at 5.0%. More fiscal and monetary stimulus will likely be required to achieve this figure. Authorities, for their part, remain reticent to deploy the kind of large-scale measures used in the past. This brings with it the prospect that 2024 will look a lot like 2023, with growth chugging along, but with limited pricing power and private credit demand. For advanced economies, this means Chinese imports will likely provide a deflationary impulse amid persistent excess supply conditions.

Key Indicators

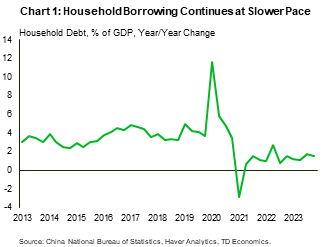

The current economic situation is best characterized by the lingering ripple effects from the overhang in the housing market. This malaise is leading to an adjustment in households’ appetite for debt and has materialized as a much slower pace of debt accumulation since the pandemic (Chart 1). The retreat in credit demand is emblematic of downbeat consumer expectations and the effect of deflation, which exacerbates debt servicing costs in real terms.

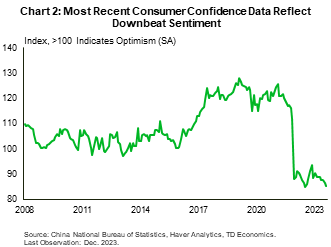

Several factors are weighing on credit demand. First and foremost is downbeat sentiment about economic prospects. Consumer confidence remains at a multi-decade low (Chart 2). With the muted economic recovery, the incentive to add leverage and benefit from future gains is limited. The recently announced 25-basis point cut to the five-year loan prime rate (a benchmark for the mortgage market) represents a baby step towards spurring residential real estate demand. However, historical precedent suggests that addressing imbalances in the housing market should take more time, and given its role in consumer wealth, portends a slow recovery in sentiment.

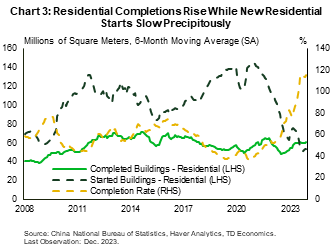

For their part, authorities have moved to restore confidence in the housing market. Recent estimates suggest that over 6,000 projects have been designated for support from banks upon recommendation by local authorities1. The current downward leg in the housing market came as developers’ access to credit was constrained by the Three Red Lines policy in 2020. With limited access to additional credit, projects ground to a halt. Getting developments across the finish line remains key to putting a floor under confidence and despite a steep reduction in new residential construction starts, completions have improved since 2022, helping lift the completion rate (Chart 3).

The second factor weighing on credit demand is the ongoing disinflation in consumer prices . As prices fall, firm revenues sag with them, making debts more burdensome. The ensuing weak wage growth means households feel the same pinch with their own debt obligations. On the inflation front, the unfortunate reality is that the economy continues to harbor excess capacity that is weighing on pricing metrics. Consumer prices excluding food and energy products advanced a tepid 0.4% y/y in January with the breakdown showing goods prices down 1.7% and services up a meagre 0.5% – decelerating from 1.0% in December.

A revival in inflation doesn’t appear to be in the offing. Export prices are down 8.4% y/y through December, while the fourth quarter economy-wide GDP deflator showed deflation persisting for the third quarter in a row. With the global economy expected to soften through the first half of the year, a revival in demand to soak up China’s excess capacity remains unlikely – especially if future stimulus puts further focus on investment and capacity increases in key industries. Lastly, we would be remiss not to mention geopolitical tensions. While exporting disinflation will be welcome for some consumers in advanced economies, not all parties are quite as welcoming – the European Commission already opened an anti-subsidy investigation into China’s battery electric vehicle exports to the bloc last October.

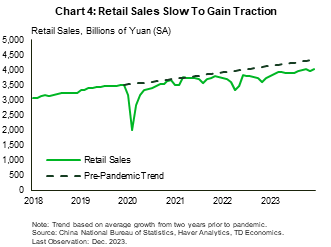

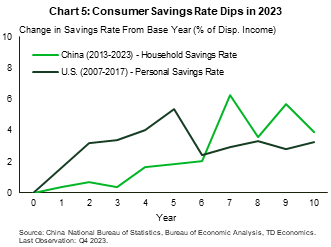

So, with soft external demand, domestic factors become more important. Authorities have tried to stimulate consumer expenditures, though that is proving to be a challenge. Retail sales linger well below their pre-pandemic trend (Chart 4). However, this is partially attributable to soft price growth, as adjusting for inflation using the CPI shows retail volumes growing roughly in line with the pre-pandemic tempo. Ultimately, the actual pace of retail expenditure growth is likely somewhere in between the two values, with the combination of a consumer pullback and excess capacity manifesting in weak inflation. One bright note, however, is that the household savings rate did fall in 2023 (Chart 5). For policymakers, a sustained pullback in precautionary savings would represent a much-welcome return of consumer vitality.

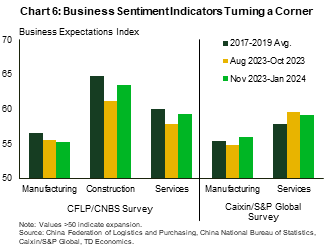

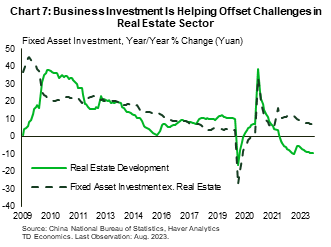

Turning to businesses, sentiment has ticked up in the past few months – with only responses in the manufacturing component of the CFLP/CNBS survey failing to show improvement (Chart 6). The slight uptick in sentiment, though a welcome development, comes at a time that private sector investment has effectively flatlined (-0.4% y/y as of December). Beyond just the private sector, fixed asset investment (excluding real estate development) advanced 7.2% y/y in 2023, with tepid price growth likely masking some of the real gains (Chart 7).

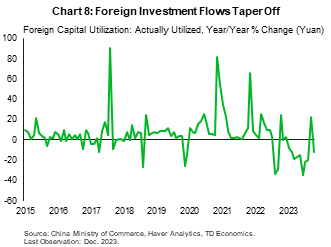

While fixed asset investment growth slowed through the end of last year, financing activity to start 2024 has disappointed. Annual social financing growth tumbled January as local currency lending fell short of last January’s strong print. For businesses and households, the low (or negative) inflation environment is making debt more burdensome decreasing the appeal of credit financing. With more challenging economic prospects foreign investors are also pulling back, as foreign direct investment (FDI) deployed was down 11.7% y/y (Chart 8).

Bottom Line

Tuesday’s government work report highlighted the use of “proactive fiscal policy and a prudent monetary policy” in 2024. Taking the statement together with a fiscal deficit target of 3.0% (lower than the 3.8% in 2023, but open to upward revision like last year) suggests that authorities’ appetite for large-scale stimulus hasn’t changed much in recent months2, despite the announced issuance of additional special-purpose bonds.

This suggests that in setting a growth target of 5.0% for 2024, officials know they will have their work cut out for them and intend to proceed gradually. Together this rules out a quick revival in China’s economic prospects that can quickly mop-up lingering capacity and restore consumer confidence. To make matters more complicated, efforts to jump start growth must be balanced against keeping the yuan from rapidly devaluing after having already slid roughly six percent against the dollar since early 2023.

On the flip side, excess capacity in China will act as a release valve for goods prices in advanced economies. In the U.S., where core goods prices are down 2.6% on a three-month (annualized) basis in January (versus an 4.5% uptick in services), ongoing deflation comes as an assist to policymakers looking to break the inflationary fever.

End Notes

- Bloomberg News (March 1, 2024) “China Banks Approve 28 Billion Loans for Property Market” https://www.bloomberg.com/news/articles/2024-03-01/china-banks-approve-28-billion-loans-for-ailing-property-market

- Xinhua News Agency (Mar. 5, 2024) “China Unveils 2024 Growth Targets with Focus on High-Quality Development” English Version: https://english.news.cn/20240305/d44cc4054efe4e5e99b06d0d22dfde03/c.html

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: