Rising Yields & Emerging Markets:

Resilience in The Face of Adversity

Sohaib Shahid, PhD, Senior Economist | 416-982-2556

Date Published: April 13, 2021

- Category:

- Global

- Global Economics

Highlights

- U.S. Treasury yields have spiked in recent months on the back of higher inflation expectations and a more optimistic growth outlook. This raises the risk of sudden capital outflows from Emerging Markets (EMs), which could derail recovery.

- Fortunately, EM's favorable external balances and less positioning overhang makes them less vulnerable to a sudden outflow of capital than in past periods of rising U.S. rates.

- Multilateral support to low-income EMs in the form of additional SDRs and temporary debt relief will also cushion against a sharp reversal of capital flows.

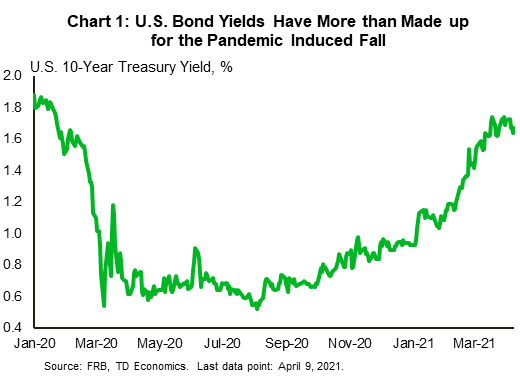

The U.S. bond market has led a global pullback in demand for government debt since the start of this year. Higher inflation expectations and a more optimistic growth outlook are partly to blame. The U.S. 10-year Treasury yield climbed to 1.67% at the time of writing, up around 75 basis points since the start of this year (Chart 1). Yields on shorter tenors have also risen recently. Late last month, the U.S. 5-year yield hit its highest point since February 2020. The jump in yields of shorter duration fixed-income assets reflects investors' concerns that the Fed might raise interest rates sooner than previously expected.

Emerging Markets Are Braving the Storm

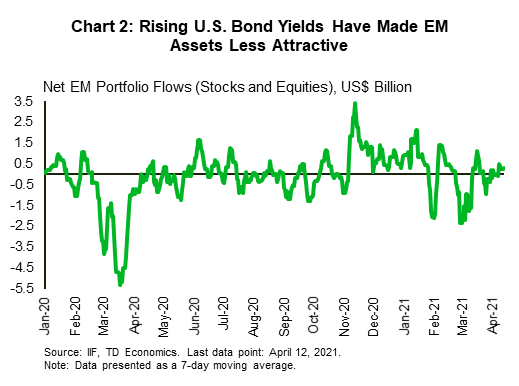

Rising U.S. yields make EM assets less attractive and EM investors jittery (Chart 2). But it's too soon to sound the alarm. Favorable external balances and relatively modest inflows prior to the pandemic make EMs less vulnerable today to a taper tantrum à la 2013. But EM currencies remain under pressure. Nearly all EM currencies have weakened against the dollar since February of this year. EMs with high levels of dollar-denominated debt are particularly vulnerable.

Weak currencies and rising inflation pressures, particularly in Brazil and India, mean that EM central banks may be forced to raise rates faster than they would've like. But raising rates could stop the nascent economic recovery, or worse, reverse it. Still, EMs are likely to weather the storm. Here's why:

- EM's overall external position has improved during the pandemic. The average EM current account balance has shifted from deficit to surplus.

- Unlike 2013, the EM exchange rate is likely undervalued by 5-10%. This undervaluation will act as a buffer against further EM currency weakness.

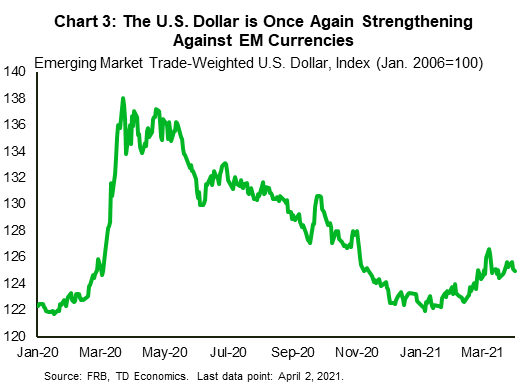

- Though EM currencies have weakened in recent weeks, the EM trade-weighted U.S. dollar is still plumbing the depths at around its late-February 2020 level (Chart 3).

Moreover, there are several developments working in EMs favor. These include higher commodity prices and growth spillovers from the $US 1.9 trillion Biden stimulus (Table 1). And, while the pandemic is still raging across some EMs such as Brazil, most of them have become reluctant to tighten restrictions. This is allowing EMs to operate at a higher capacity than most AEs.

Of course, EMs are not a monolith. Take Turkey's example. The recent sacking of the Central Bank's Governor led to the Turkish Lira stumbling by as much as 15%. Equities and bonds also fell on the news. A persistent tightening in financial conditions via Lira depreciation, widening credit spreads and rise in local currency yields will weigh on Turkey's growth this year.

Commodity Price Outlook

| Commodity | 2020 | 2021 | 2022 | |||||||||

| Q1 | Q2 | Q3 | Q4 | Q1F | Q2F | Q3F | Q4F | Q1F | Q2F | Q3F | Q4F | |

| Crude Oil (WTI, $US/bbl) | 46 | 28 | 41 | 42 | 2 | 63 | 65 | 60 | 59 | 58 | 57 | 56 |

| Natural Gas ($US/MMBtu) | 1.91 | 1.71 | 1.99 | 2.53 | 3.51 | 2.70 | 2.60 | 3.00 | 3.10 | 2.90 | 2.80 | 3.15 |

| Gold ($US/troy oz.) | 1582 | 1708 | 1909 | 1874 | 1795 | 1725 | 1700 | 1675 | 1650 | 1625 | 1600 | 1575 |

| Silver ($US/troy oz.) | 16.90 | 16.38 | 24.34 | 24.45 | 26.24 | 26.25 | 26.00 | 25.75 | 25.00 | 24.50 | 24.00 | 23.50 |

| Copper (cents/lb) | 255 | 243 | 296 | 326 | 385 | 395 | 384 | 370 | 355 | 347 | 363 | 399 |

| Nickel ($US/lb) | 5.76 | 5.53 | 6.45 | 7.24 | 7.96 | 7.60 | 7.40 | 7.37 | 7.35 | 7.37 | 7.60 | 8.05 |

| Aluminum (cents/lb) | 77 | 68 | 77 | 87 | 8 | 94 | 87 | 85 | 83 | 81 | 82 | 84 |

| Wheat ($US/bu) | 6.60 | 6.46 | 6.36 | 6.84 | 7.41 | 7.35 | 7.25 | 7.15 | 7.10 | 7.05 | 6.95 | 6.90 |

Multilateral Support Puts A Floor Under Emerging Market Economies

In related news, the IMF is likely to approve a new SDR allocation of US$650 billion by August 2021 at the earliest. This should help EMs faced with dollar funding pressures. SDRs are IMF issued international monetary assets. They are used by countries as reserves and can be sold and used as payment to other central banks. We had proposed almost a year ago for the IMF to inject additional SDRs (see report). We are glad to see it finally being done.

Low-income EMs also have another reason to cheer about this year. The G20 recently extended its Debt Service Suspension Initiative (DSSI) until end-2021. The DSSI was due to end in June and was launched last May. It offers temporary debt relief to low-income EMs reeling from the impact of the pandemic. So far, 46 countries have requested debt relief worth $12.5 billion. The new extension would cover an estimated $9.9 billion in bilateral debt payments.

Emerging Markets' Recovery on a Stronger Footing

Despite the rising U.S. bond yields, the outlook for EMs is brighter today than it was late last year (see our latest Quarterly Economic Forecast). EMs are benefiting from relatively few restrictions, rising commodity prices, recovering global trade and accelerated vaccinations thanks to the COVAX facility. Support from the G20 and the IMF has also put a floor under EM economies. Still, all this is not to paint an overly rosy picture of the EM outlook. Its to acknowledge EM's resilience in the face of rising yields and to highlight what is working in EM's favor.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: