A Primer on Carbon Pricing and Carbon Border Adjustments

Beata Caranci, Senior Vice Prsident and Chief Economist

Francis Fong, Managing Director & Senior Economist

Date Published: June 7, 2021

- Category:

- Global

- Global Economics

Ahead of the April U.S. climate summit, several advanced economies, including the U.S., the UK, Canada, Japan, and the EU, announced more aggressive interim emissions reduction targets on the way to net zero by 2050. For instance, the U.S. lifted its target to 50-52% below 2005 levels by 2030, from a previous commitment of 26-28% by 2025. Canada followed suit citing a 40-45% emissions reduction target by 2030, from 36% previously. The commitment is clear within the advanced world, but now the focus is on what package of policies is required for the respective governments to reach these targets.

Carbon pricing has been at the center of these discussions for some time and is rising in popularity due to its incentive framework and ease of implementation. And now, a new kid is on the block. A debate is growing over the adoption of carbon border adjustments – levies that would be applied to imports from countries that do not price carbon. This policy framework is known in theory only and has not yet been fully tested in practice. This makes it a contentious issue despite the growing number of advanced countries considering them, including the U.S. and Canada.

This report offers a question and answer overview of carbon pricing and border adjustments, discussing why countries are turning to these as go-to mechanisms to incent business and household behaviours. However, every policy choice carries risks and unintended consequences. Government attempts to navigate around the shortcomings can lead to complicated designs and reduced effectiveness. Meanwhile, legal issues can throw up further road blocks on implementation.

Carbon Pricing

- How does carbon pricing work?

- What are the key considerations for carbon pricing?

- What is Canada's implementation and policy framework?

- How does Canada's carbon pricing framework compare internationally?

Carbon Border Adjustments (CBAs)

- Why are some countries considering carbon border adjustments?

- What are the challenges of CBAs?

- Which countries are considering the CBA framework?

1. How Does Carbon Pricing Work?

Carbon pricing is one of the more broadly used policy tools applied by governments. It exists in some form within 45 countries, including Canada, Norway, Switzerland, New Zealand, the UK, South Korea and the EU. Dozens more are scheduled to implement carbon pricing or are considering it, including China, Japan, and Indonesia. The U.S. does not have a national carbon price structure, nor is one currently under consideration for near-term implementation. At the regional level, there are several small-scale carbon pricing initiatives. These include the California-Quebec emissions trading scheme (ETS), an ETS for the power sector in 11 states in the Northeast, and most recently a proposal for an ETS in Washington state.

The objective of carbon pricing is to incentivize individuals and businesses through a price mechanism to shift their activities away from those that emit GHGs. It internalizes the cost of pollution along the entire value chain of how goods and services are produced by setting a price on emissions. As each participant in the economy pays for the price of their own emissions, a domino effect of higher costs is passed (to some extent) to the end-user of a product or service. In other words, the purchase price now incorporates emission costs, in addition to the usual factors of labor and other input costs. The goal is to use the price mechanism to discourage demand for high-emitting products.

Carbon pricing has several advantages relative to direct regulation. First, carbon pricing tends to have broad coverage, since it targets emissions rather than individual activities. Policymakers need not worry that an activity or source of emissions falls outside regulatory borders or that highly complex regulations might be needed to ensure emissions are sufficiently covered. Second, carbon pricing does not force any individual or business to decarbonize or push governments to pick winners and losers by imposing how to decarbonize – the agency lies with the individual as to how or whether they will respond to the price signal. Lastly, carbon pricing provides policymakers with a lever that they can change, gradually over time, to get the desired emissions-behavior structure. This should permit a smoother transition. A well-telegraphed path on carbon prices offers a clear signal to market participants on direction, while also allowing time for shifts to occur towards lower-emitting activities via the adoption of technologies and/or processes.

There are two main types of carbon prices:

- A straight carbon price simply applies a uniform price on all emissions.

- An emissions trading scheme (ETS), more commonly known as cap-and-trade, puts a ceiling on the level of emissions and creates emissions credits that are auctioned and traded by participants – typically made up of large industrial emitters. An ETS can also take the form of a baseline and credit system, in which baseline emissions standards are established by industry and credits are purchased for those that emit beyond those levels.

| Country | Current Climate Targets (April 2021) | Approx. Gross Reduction in Emissions from 2019 Levels | Net Zero Target? |

| Canada | 40-45% below 2005 levels by 2030 | 40-45% | Yes, 2050 |

| UK | 78% below 1990 levels by 2035 | 64% | Yes, 2050 |

| US | 50-52% below 2005 levels by 2030 | 42% | Yes, 2050 |

| China | 65% reduction in emissions intensity per unit of GDP below 2013 levels by 2030 | Dependent on GDP, emissions expected to peak before 2030 | Yes, 2060 |

| EU | 55-57% below 2005 levels by 2030 | 42-45% | Yes, 2050 |

| Australia | 26-28% below 2005 levels by 2030 | 30-32% | Yes, 2050 |

| Japan | 46% below 2013 levels by 2030 | 36% | Yes, 2050 |

| India | 33-35% reduction in emissions intensity per unit of GDP below 2005 levels by 2030 | Dependent on GDP, no target for peak in emissions | No |

2. What are the Key Considerations for Carbon Pricing?

There are several concerns to exclusively using carbon pricing to reduce emissions, resulting in ancillary policies to address shortcomings. These will be further discussed in the section on Canada's carbon price implementation.

Inequitable incidence of the carbon price

Carbon prices tend to be regressive in isolation, disproportionately impacting lower-income households. Basic living expenses, such as food, home heating and transportation, tend to be both carbon-intensive and form a larger share of lower-income households' expenditures. To the extent that carbon pricing disproportionately impacts these expenditures, the incidence of these policies will likewise hurt lower-income households more, particularly those living in rural or distant areas where fuels tend to be more expensive or used to a greater extent.

In addition, certain institutions also face more difficulty in passing on carbon prices to their customers. Organizations such as non-profit institutions, charities, religious institutions, hospitals, and municipalities all would face higher costs with little ability to raise "consumer prices" to compensate.

Industries or sectors with significant barriers to carbon abatement

Carbon pricing is very effective when there is a clear decarbonization pathway available for a given industry or business. However, in sectors where decarbonization technologies are nascent, require significant infrastructure, or have cross-industry dependencies that are beyond the scope of an individual business, even a very large price signal might not trigger the needed shift to a lower or zero-emitting alternative at the speed in which countries need to reach their climate objectives.

Competitiveness concerns and carbon leakage

The primary concern raised by businesses is that any country unilaterally applying a carbon price creates a competitiveness challenge for emissions-intensive and trade-exposed (EITE) sectors, since businesses would have to pay for a net new cost to the which their international competitors are excluded from. This, in turn, could lead to carbon leakage. Carbon-intensive production is incented to move offshore to a jurisdiction without a carbon price, resulting in a net economic loss and nullifying the emissions reduction that the carbon price was meant to generate in the first place. This is a natural shortcoming of countries imposing carbon prices unilaterally as the true benefit is realized only when it is widely or globally adopted. For countries that are adopting carbon prices, there are policies that can alleviate these concerns. Notably, these include carbon border adjustments and output-based allocations, both of which are discussed below.

3. What is Canada's Implementation and Policy Framework?

Canada does not, in fact, have a single carbon pricing framework. The pan-Canadian framework consists of a set of provincial carbon price policies that are required to meet a certain level of emissions coverage and stringency relative to a federal benchmark. Any province failing to meet that benchmark triggers a federal backstop. For the purposes of this report, we will focus on the details of that backstop which currently only applies in four provinces: Alberta, Saskatchewan, Manitoba, and Ontario.

The federal backstop covers approximately 79% of Canada's emissions, including nearly all fuel combustion sources and some non-combustion sources. As of 2021, the carbon price is set at $40 per tonne of CO2-equivalent and is set to rise to $170 per tonne by 2030. To address each of the above considerations, the federal government has implemented a series of ancillary policies. These policies create a gap between what can be considered the "posted carbon price" stated above, relative to the "effective carbon price" that end-users absorb. In effect, this creates a slower transition to low emission outcomes because the pure price-incentive structure is muted.

To address the issue of inequitable incidence, the federal backstop employs a carbon fee and dividend model where 90% of the revenue collected is returned back to households as a lump sum payment. The remaining 10% is spent on clean energy projects in collaboration with industry. The same rebate is provided to all households and is based on the average level of emissions, though the payment differs depending on household size for each of the four provinces in which it applies. A 2-parent household with a single dependent in Ontario, for example, would have received $525 this year and this amount would grow as carbon revenue rises.

In absolute terms, higher-income households spend a greater amount and therefore contribute to higher greenhouse gas emissions relative to lower-income households. As a result, the rebate offers a progressive effect, in that lower-income households receive more than they pay in higher prices due to the carbon price. Because the backstop only applies in four provinces, revenue collected is only returned to residents of those provinces. However, many of the provincial policies also employ a fee and dividend model.

It is important to note that the fee and dividend model is not universally supported as an ideal climate policy tool, with many suggesting that revenues would be better spent investing in clean technology and other projects to accelerate the transition to a low carbon economy rather than simply returning revenues back to households. The fee and dividend model does neutralize the punishment aspect of a carbon price on individual households, but still imposes a higher cost structure on producers that emit greenhouse gases relative to those that do not. It is important to note that the telegraphed price is also an important aspect of the policy. By establishing a long-term path, policymakers are, in effect, price signaling to households and businesses of the future burden they will face in order to incentivize clean technology investments or shifts in activities that might take several years.

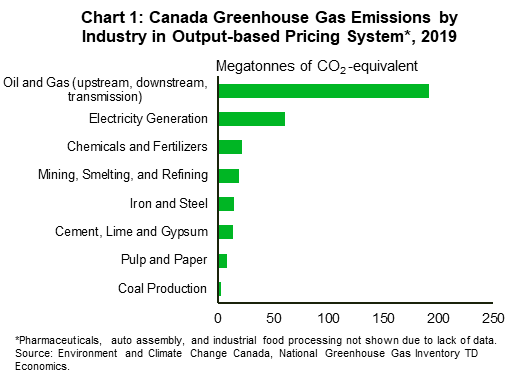

The second aspect of the federal backstop addresses some of the competitiveness concerns posed by the carbon price by establishing a system designed to insulate EITE sectors from the carbon price while still incentivizing a shift to lower emissions, much in the way the rebate system does for individuals. This system, referred to as the Output-Based Pricing System (OBPS), sets baseline standards for the emissions intensity of each industry and each product produced in EITE sectors. Firms that participate in the OBPS are only responsible for their emissions over their respective baselines, which for most industries is set at 80% of the average emissions intensity for a given product (see Chart 1 for industries covered by the OBPS). For those whose emissions intensity falls below the baseline, the government issues credits which can then be saved for future use or sold to other participants in the OBPS to be used to offset their excess emissions, thereby incentivizing all producers to continually lower the emissions intensity of their production.

As an example, an industry producing widgets might have an average emissions intensity of 1.25 tonnes of carbon emitted per widget produced – 80% of that would be 1 tonne per widget. Producers of those widgets would only pay the $40 per tonne carbon price if their emissions intensity was beyond 1 tonne. If a producer made 10 widgets at the average 1.25 tonnes per widget, they would end up paying $100 ($40 x 0.25 x 10) rather than $500 if the full carbon price were applied to total emissions.

Note that Canada's carbon price implementation does not solve all of the issues related to carbon pricing. Importantly, while the application of the OBPS does address some of the competitiveness concerns by muting the impact of the carbon price, it does not eliminate the possibility of carbon leakage since domestic industries will still be subject to emissions costs.

4. How does Canada's Carbon Pricing Framework Compare Internationally?

According to the World Bank , 45 national jurisdictions are covered by either a carbon price or an ETS, including those covered under the European Union (EU) ETS. Canada is set to join the ranks of Sweden, Switzerland, Finland, and Norway as having one of the highest posted carbon prices in the world. However, comparing straight prices is not a useful metric for comparing relative stringency. Each jurisdiction's carbon price varies given differences in economic structure and how fuels are consumed or produced. How each jurisdiction uses revenues raised also differs, resulting in different effective price signals.

Switzerland, for example, currently has one of the highest carbon prices in the world, but it has no domestic fossil fuel production. All fuels are imported, meaning the fuel levy within its carbon price framework is applied at the border. Meanwhile, large industrial emitters are covered separately by the EU ETS, which has its own market-driven price. To incentivize the transition to a low carbon economy, Switzerland's fuel levy need only be high enough to transition consumers away from burning fossil fuels in, say, transportation and buildings, while the EU ETS price needs to be high enough to drive the shift within the industrial sector. Compare that to Canada where a singular carbon price needs to be high enough to drive the transition in not just those areas, but within the upstream oil & gas sector, as well.

This gets at the heart of how carbon prices are designed as one part of a larger menu of climate policies. Price levels are not set arbitrarily at some gradually increasing level simply to capture a growing share of carbon-emitting activities, though that is a factor. Rather they are modelled constructs of how entire energy systems can shift to a lower level of emissions, taking into account the cost of all of the carbon abatement options that will need to be deployed in the process which, as discussed above, can face significant barriers.

The outlook for Canada's climate policy framework is thus not only about a gradually increasing carbon price, but rather how policy can address all the various issues surrounding the transition to net zero. These include using regulation to address emissions that aren't covered by carbon pricing and leveraging direct investments and infrastructure spending to lower the cost or de-risk carbon abatement and clean technology investments.

Carbon Border Adjustments (CBAs)

1. Why are some countries considering carbon border adjustments?

Carbon border adjustments (CBAs) are commonly cited as a tool to help address the "leakage" problem inherent with carbon pricing.

CBAs have three main objectives:

- Address carbon leakage from carbon pricing

- Address competitiveness issues from carbon pricing

- Influence global climate policy by leveraging advanced economies consumption and supply chains

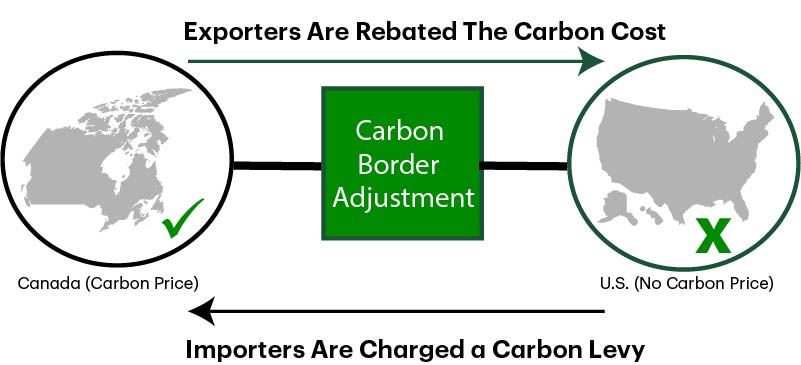

In its purest sense, border adjustments achieve the first two goals by levelling the playing field between domestic producers who face a carbon price and foreign producers who do not. Import levies are applied to goods brought into a carbon pricing country based on the foreign producer's emissions content of those goods and priced to be equivalent to the carbon price burden faced by a domestic producer. Simultaneously, exporters are rebated the carbon costs they incur when goods are produced domestically but are then exported to foreign countries that do not price carbon. In this two-way fashion, domestic producers can compete on an equivalent cost-basis relative to foreign producers regardless of whether they are competing domestically or internationally. This notionally eliminates both the competitive pressures imposed by carbon pricing and the incentive to move production overseas.

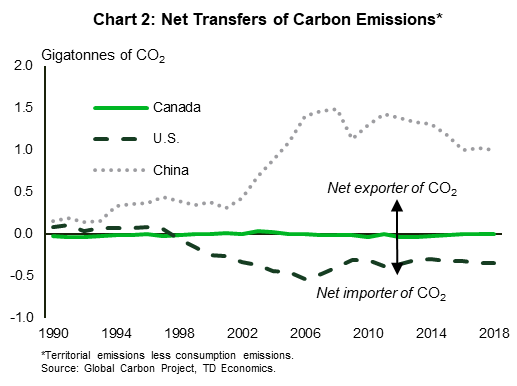

The third objective is theoretically achieved as the clean energy transition progresses. Domestic producers that are investing in clean technologies and lowering their emissions intensity (and thus their carbon costs) are gaining on a cost basis relative to their foreign competitors who will face a continually rising import levy over time. In order for foreign producers to be able to compete and retain access to those markets, either industry itself will need to keep pace in terms of lowering their emissions intensity, or governments will need to impose their own carbon price in order to avoid the levy. In this way, advanced economies hope to leverage their position as the world's dominant consumers and orient global supply chains to influence countries that would otherwise not pursue climate policies on their own.

To date, no countries have formally adopted a CBA, but many advanced economies that have implemented stringent carbon pricing frameworks are considering its framework. Recent dialogue within the EU, U.S., Canada, and the UK have shown increased interest in adopting the policy and cooperating on an implementation model.

2. What are the Challenges of CBAs?

Unfortunately, CBAs are extremely complex to design and implement. There are a series of issues that need to be addressed both in terms of how the import levy will be applied and the legality of the border adjustment itself.

Trade coverage

The first question in designing a CBA is simply around what trade will be included. Imports will naturally be covered, but exports are trickier. Rebating carbon costs paid by export-oriented firms neutralizes the competitiveness concern, but essentially defeats the environmental purpose of having a carbon price by allowing these export-oriented firms to evade it. They may even be incentivized to raise the emissions intensity of their exporting activities. However, the actual net difference in GHG emissions, globally and in the long run, is dependent on the relative emissions intensity between domestic and foreign competitors. If domestic firms have a lower emissions intensity, then a CBA that covers exports would allow those firms to potentially avoid being displaced internationally by more carbon-intensive firms. In other words, there are arguments to be made on both sides.

Geographic and sectoral scope

A well-functioning CBA needs to also address which countries and sectors will be covered. In both cases, higher coverage leads to a stronger environmental outcome and less carbon leakage, but also increases the complexity. A CBA could apply to all trading partners, all products and sectors, and all emissions types for a given country. But, assessing the emissions content of thousands of different categories of traded goods would be administratively unwieldy with incredibly complex data requirements for the emissions content of production, intermediate inputs, transportation, and all other emissions sources that would need to be tracked.

Exemptions can be made. Low-income countries, those that contribute very little to global emissions, those that have strong domestic climate ambitions, etc, can all be used as defining attributes to warrant exclusion from a border adjustment. In addition, sectoral scope can focus on those sectors that are actually at risk of leakage – EITE sectors, for example. However, each action here would again present its own challenges. Choosing to apply an import levy on some countries but not others can run afoul of WTO rules specifically prohibiting trade discrimination of this type. Meanwhile, excluding non-EITE sectors from a border adjustment reduces its environmental impact.

Estimating emissions content

Of course, these factors are all secondary to being able to estimate the emissions content of imported goods and apply a levy in a fair and balanced way. This is not a simple task. The import levy would ideally be based on a detailed assessment of products being imported to truly reflect their emissions intensity. However, as mentioned, this would have complex data requirements making it unfeasible in the short run. Consider a hypothetical smartphone imported to the United States. In estimating the emissions content of a that phone, policymakers would need data on the emissions intensity of, notionally, the entire value chain of how one is produced, from the rare earth minerals that were mined in inner Mongolia, to the silicon chips, LCD panels, sensors and camera equipment manufactured in China, Korea, and Japan, aluminum mining in Canada for manufacturing the frame and all of the shipping costs from each supplier to bring those goods to America. This information would not only need to be assessed but updated regularly.

A simpler path is to base the import levy on benchmarks across industries, which could include best practices, worst practices, average intensities – even the average intensity within the country deploying the CBA could be used in order to hold foreign countries to the same standards of a domestic industry. But these too have drawbacks. Benchmarks that are too stringent, for example, punish foreign producers with lower emissions-intensities than their benchmark because the levy is flat regardless of their environmental performance. Conversely, a benchmark that is too lenient provides little protection against carbon leakage because it isn't sufficient to equilibrate the carbon costs faced by domestic producers.

Legal concerns

All of the above issues underscore the complexity of designing an effective and efficient CBA. The legality of the policy itself is subject to how it treats different countries and sectors. At the most basic level, WTO rules prohibit favourable treatment for domestic products over imported products (rules on subsidies and countervailing measures) and discrimination due to country-level factors (most-favoured nation treatment).

Most-favoured nation rules could be considered broken if only some countries were exempted from a CBA – based on having a strong domestic climate policy or having ratified the Paris climate agreement, as examples. Subsidy rules could be considered broken if, for example, exporters were rebated their carbon costs, or if import levies were not accurate enough to equilibrate with carbon costs paid for by domestic firms. Notably, CBAs are considered incompatible with programs like Canada's OBPS. The OBPS already shields domestic EITE firms from the carbon price. Imposing an import levy that equates to the full carbon price would likely be considered a domestic subsidy. A similar program exists in the EU ETS, where free allocations of emissions credits are given to EITE firms. In other words, adopting a CBA means phasing out these types of programs or having a comprehensive mutual agreement on exemptions, partial-exemptions and inclusions.

Advanced countries looking to implement border adjustments have one way of addressing these concerns. As part of a series of general exceptions to WTO rules, article XX(b) stipulates that policies can be implemented if they are "necessary to protect human, animal, or plant life or health." Given the uncertainty with which developing countries would pursue climate policy in the absence of CBAs, policy experts are referencing this clause as a potential way for advanced countries to move forward. However, it is far from certain that a CBA will pass legal muster.

3. Which Countries are Considering the CBA Framework?

The most advanced discussion on the use of CBAs is currently in the European Union. The EU has been officially exploring a carbon border adjustment mechanism (CBAM) since the launch of the European Green Deal at the end of 2019. After several rounds of consultations, the European Commission plans to table a legislative proposal in short order (Q2 2021). While a full-fledged CBA will likely not emerge this year, a pilot project is expected to be launched this summer. How the EU addresses the many implementation hurdles will likely form the model for how this tool is deployed elsewhere – particularly how it addresses free allocation and how industry responds.

The UK, Canadian, and U.S. governments have also expressed interest in deploying a CBA , with the former 2 suggesting a joint collective between advanced economies. The U.S. experience will be unique, however, since they are the only country considering a CBA without a national carbon price. If implemented, a U.S. border adjustment would simply act as an import tariff that would almost certainly be prohibited under WTO rules. However, it's unclear how any WTO violations would be resolved at this point. Under the Trump administration, the nomination of new judges was blocked and the WTO appellate body now has insufficient judges to adjudicate on new and complex issues. Under the Biden administration, there has yet to be a reversal of this approach. Indeed, despite a September 2020 report from the WTO that the U.S. "has not met its burden of demonstrating that the measures are provisionally justified" when it imposed a broad set of severe import tariffs on China, those tariffs still exist today under president Biden despite calls to overturn them. In 2018, EU leaders undertook a review of the WTO dispute settlement process aiming to address issues raised by the U.S., but those proposals were rejected. More recently, the EU released a new trade strategy which conceded many of the issues raised, paving the way for any agreement struck with the U.S. and other nations for carve-outs or alignment to unilateral policies related to the protection of the environment and other security measures.

A U.S. carbon border adjustment would align well with foreign policy statements and positions the Biden administration has taken already. Much of the focus of the president's speeches and in the recent infrastructure announcement has been on the potential for the clean energy transition to boost domestic industry and create jobs within the United States.

This broader shift towards more insular policies may benefit Canada. Although no historical evidence of the economic impacts of CBAs are available, from a theoretical standpoint, a re-orientation of supply chains away from developing countries towards advanced economies may result in an acceleration of the onshoring trend seen in the last several years. The clean energy transition presents an enormous opportunity for Canada to embed itself in those supply chains of 'like-minded' countries on climate change policies that will emerge from clean technology development, to mining, carbon capture, low carbon cement and steel, and to electric vehicle manufacturing.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: